Haptics Tech Report - Applications in Robotics and Physical AI.

Methodology and Definitions

This report analyzes the haptics technology landscape with a focus on applications in robotics and Physical AI. The analysis covers the period from 2018 to the present day, providing a comprehensive overview of technological trends, research breakthroughs, and commercial developments.

For the purpose of this report, the following definitions apply:

- Haptics: The science and technology of transmitting and understanding information through touch.

- Tactile Sensing: The technologies that measure and interpret physical interactions at the point of contact, including pressure, force, vibration, and temperature.

Data is compiled from reputable financial databases, industry publications, and company announcements. The analysis is based on a combination of primary and secondary sources, including academic publications, peer-reviewed journals, conference proceedings, market research reports, industry news, and public company filings. All major claims and data points are referenced to their original sources.

Executive Summary

This report argues that haptics, or the sense of touch, is the critical enabling technology for the next generation of robotics and Physical AI. While vision has been the primary focus of robotic perception, touch is the key to unlocking dexterous manipulation, safe human-robot collaboration, and the automation of complex, contact-rich tasks. This analysis provides an overview of the haptics landscape, identifying key technological trends, evaluating the commercial landscape, and outlining a framework for identifying high-potential opportunities.

The three most promising investable wedges in the haptics ecosystem are:

- Standardized Tactile Sensor Modules: The development of a robust, scalable, and cost-effective tactile sensor that can be integrated across a wide range of robotic platforms, becoming the de facto standard for the industry.

- Tactile Foundation Models: The creation of sophisticated software models that can interpret and generalize tactile data from various sensors, creating a software-based moat and enabling a new class of robotic skills.

- Vertical Solutions for High-Value Applications: The development of integrated haptic systems for specific, high-margin applications where the sense of touch is indispensable, such as surgical robotics, high-value manufacturing, and remote inspection and maintenance.

The primary bottlenecks that have so far prevented the commoditization of haptics are:

- The Durability-Sensitivity Trade-off: The difficulty of creating sensors that are both highly sensitive to subtle forces and robust enough to withstand millions of cycles of contact in industrial environments.

- The Integration Challenge: The complexity of integrating tactile sensors into robotic systems, including the mechanical, electrical, and software interfaces, as well as the calibration and maintenance burden.

- The Sim-to-Real Gap: The significant challenge of accurately simulating contact-rich tasks, which makes it difficult to train and validate tactile-based robotic systems in simulation before deploying them in the real world.

Evaluation Rubric

To provide a structured and repeatable framework for assessing the various technologies and companies in the haptics landscape, this report will utilize the following evaluation rubric. Each approach will be analyzed against these six key dimensions to provide a clear, decision-relevant comparison.

| Criterion | Description | Key Metrics |

|---|---|---|

| Signal Richness | The quality, diversity, and resolution of the tactile data generated. | Normal force, shear force, vibration, temperature sensing, spatial resolution, temporal bandwidth. |

| Mechanical Robustness | The ability of the sensor to withstand the rigors of real-world operation over extended periods. | Cycles-to-failure, resistance to contamination (dust, liquids), signal drift, calibration frequency. |

| Integration Burden | The complexity and cost associated with integrating the sensor into a complete robotic system. | Wiring complexity, packaging/form factor constraints, computational requirements, latency, software API. |

| Manufacturability/Cost | The feasibility and economics of producing the sensor at scale. | Bill of Materials (BOM) cost, manufacturing yield, calibration process complexity, scaling pathway. |

| Learning Leverage | The extent to which the sensor's data can be used to enable new robotic skills and improve learning-based models. | Unlocking new capabilities (e.g., texture recognition) vs. improving reliability of existing tasks. |

| Customer Pull | The degree of existing market demand and the tangible value proposition for end-users. | Who is paying for this now? What Key Performance Indicator (KPI) does it move (e.g., pick success rate, damage rate, cycle time)? |

C) Taxonomy of Tactile Approaches

Figure 1: A radar chart comparing the five dominant tactile sensor archetypes across the six key evaluation criteria. This visualization highlights the inherent trade-offs in the haptics landscape, where no single technology excels across all dimensions.

To understand the haptics landscape, it is essential to move beyond buzzwords and organize the field by its fundamental sensor archetypes. Each archetype presents a unique set of trade-offs in terms of signal richness, robustness, cost, and integration complexity. This section provides a detailed analysis of the five dominant archetypes that define the current state of tactile sensing in robotics.

1. Vision-Based Tactile Sensors (VBTS)

Vision-based tactile sensors, such as those pioneered by GelSight, represent a significant advancement in robotic touch. These sensors operate by using a camera to observe the deformation of a soft, elastomeric gel pad as it comes into contact with an object. This deformation is then analyzed to reconstruct a high-resolution 3D map of the object's surface, providing rich information about its geometry, texture, and the forces being applied.

| Best-in-Class Metrics | Typical Failure Modes | Integration Burden | Best-Fit Applications |

|---|---|---|---|

| High spatial resolution (>1000 taxels/cm²), rich contact geometry, high-fidelity texture and shear force measurement. | Susceptible to contamination from dust and liquids, which can obscure the camera's view. The elastomeric gel can also be damaged by sharp objects or wear out over time. | High integration burden due to the need for a camera, illumination, and image processing pipeline. Can have higher latency compared to other sensor types. | High-precision manipulation, quality control and inspection, material and texture recognition, and applications where rich contact information is critical. |

Key Examples and Representation-Learning Progress:

Recent research has focused on using deep learning to extract increasingly sophisticated information from VBTS data. For example, researchers have demonstrated the ability to perform in-hand object pose estimation, slip detection, and material classification with high accuracy [1]. The development of large-scale, open-source datasets, such as Touch100k, is further accelerating progress in this area by enabling the training of powerful tactile representation models [2].

References:

[1] Li, H., et al. (2025). Classification of Vision-Based Tactile Sensors: A Review. arXiv:2509.02478.

[2] Lin, Y., et al. (2024). Touch100k: A Large-Scale Touch-Language-Vision Dataset. arXiv:2406.03813.

2. Resistive/Capacitive Arrays

Resistive and capacitive tactile sensors are the most established and widely used technologies in robotics. Resistive sensors measure the change in resistance of a conductive material when pressure is applied, while capacitive sensors measure the change in capacitance between two electrodes as they are deformed. These sensors are typically arranged in arrays to provide a distributed sense of touch.

| Best-in-Class Metrics | Typical Failure Modes | Integration Burden | Best-Fit Applications |

|---|---|---|---|

| Scalable to large areas, low power consumption, and relatively low cost. | Lower spatial resolution compared to vision-based sensors, susceptible to mechanical wear and tear, and can suffer from hysteresis (failure to return to original state after pressure is removed). | Moderate integration burden, as they require specialized electronics to read out the sensor array. | Applications where robustness and cost-effectiveness are more important than high spatial resolution, such as in industrial grippers, prosthetic hands, and safe human-robot collaboration. |

Key Examples and Manufacturing Paths:

These sensors have a clear and established path to mass production, leveraging mature manufacturing processes from the electronics industry. Companies like Pressure Profile Systems (PPS) and Tekscan have been producing these sensors for decades. The primary innovation in this area is focused on developing new materials and manufacturing techniques to improve the durability, sensitivity, and flexibility of these sensors [3, 4].

References:

[3] Pressure Profile Systems. (n.d.). Tactile Sensing Technology. Retrieved from https://pressureprofile.com/about/tactile-sensing

[4] Peng, Y., et al. (2021). Recent Advances in Flexible Tactile Sensors for Intelligent Robotics. Micromachines, 12(8), 948. https://doi.org/10.3390/mi12080948

3. Magnetic Tactile Sensors

Magnetic tactile sensors are an increasingly active area of research, offering a compelling combination of durability and sensitivity. These sensors typically work by embedding a magnet in a soft, deformable material. When an external force is applied, the magnet moves, and this change in the magnetic field is detected by a nearby magnetic sensor (such as a Hall effect sensor). This allows for the measurement of both normal and shear forces with high precision.

| Best-in-Class Metrics | Typical Failure Modes | Integration Burden | Best-Fit Applications |

|---|---|---|---|

| High durability, low hysteresis, good sensitivity to multidirectional forces, and resistance to environmental contaminants. | Susceptible to interference from external magnetic fields, which can require shielding. The integration of magnets and sensors can also be complex. | Moderate integration burden, requiring careful placement of magnets and sensors, as well as calibration to account for magnetic field nonlinearities. | Applications requiring high durability and robustness, such as in industrial automation, agriculture, and underwater robotics. Also promising for prosthetic hands and other applications where long-term reliability is critical. |

Key Examples and Research Trends:

The key advantage of magnetic tactile sensors is their robustness. Because the sensing element (the magnetic sensor) is physically separated from the point of contact, it is less susceptible to mechanical wear and tear. This makes them well-suited for applications where the sensor will be subjected to repeated impacts or harsh environmental conditions. Recent research has focused on developing "magnetic skin" that can cover large areas of a robot, as well as creating more sophisticated sensor designs that can measure a wider range of tactile information [5, 6].

References:

[5] Wu, J., et al. (2025). Advances in Magnetic Materials and Sensors for Tactile Perception. Advanced Materials Technologies, 2500110.

[6] Man, J., et al. (2022). Recent Progress of Biomimetic Tactile Sensing Technology Based on Magnetic Sensors. Biosensors, 12(11), 1054. https://doi.org/10.3390/bios12111054

4. Force/Torque at Wrist + Joint Torque Sensing

While not a form of tactile sensing in the traditional sense, force/torque (F/T) sensors mounted at a robot's wrist or integrated into its joints provide a crucial, albeit low-resolution, form of touch. These sensors measure the overall forces and torques acting on the robot's end-effector, providing essential feedback for controlling the robot's interaction with its environment. They serve as a critical baseline for contact-rich tasks and are often used in conjunction with other tactile sensors.

| Best-in-Class Metrics | Typical Failure Modes | Integration Burden | Best-Fit Applications |

|---|---|---|---|

| High precision and accuracy, high stiffness, and robust to industrial environments. | Can be damaged by overloading (exceeding the sensor's force/torque limits). The sensor's own weight can affect measurements and may require compensation. | Low to moderate integration burden. Wrist-mounted sensors are relatively easy to install, but require careful calibration. Joint-level torque sensors are integrated directly into the robot's design. | High-precision assembly, grinding, polishing, and other tasks requiring precise force control. Also used for safety, allowing the robot to detect and react to unexpected collisions. |

Key Role as a Baseline Technology:

F/T sensors are a mature and widely adopted technology in robotics. Companies like ATI Industrial Automation and Robotiq offer a wide range of off-the-shelf sensors that are used in thousands of industrial applications [7, 8]. While they do not provide the rich, localized contact information of a tactile sensor, they are essential for controlling the overall forces of interaction. In many applications, F/T sensors provide the "big picture" of the interaction forces, while tactile sensors provide the fine-grained details.

References:

[7] ATI Industrial Automation. (n.d.). Multi-Axis Force/Torque Sensors. Retrieved from https://www.ati-ia.com/products/ft/sensors.aspx

[8] Robotiq. (n.d.). FT 300-S Force Torque Sensor. Retrieved from https://robotiq.com/products/ft-300-force-torque-sensor

5. Electronic Skin (E-Skin)

Electronic skin, or e-skin, represents a paradigm shift in robotic sensing, moving from localized tactile sensors to large-area, flexible, and distributed sensor networks that can cover the entire body of a robot. This technology is critical for the future of safe and effective human-robot collaboration, as it allows a robot to be aware of its entire physical volume and any unintended contact. E-skin is still in its nascent stages, with most of the development happening in research labs, but it holds the potential to revolutionize robotic perception.

| Best-in-Class Metrics | Typical Failure Modes | Integration Burden | Best-Fit Applications |

|---|---|---|---|

| Large-area coverage, flexibility, and the ability to integrate multiple sensing modalities (e.g., pressure, temperature, proximity). | Susceptible to damage from tearing or puncture. The wiring and data acquisition for a large-area e-skin can be complex and challenging. | Very high integration burden, as it requires a complete rethinking of the robot's mechanical and electrical design. Data processing for a large number of sensors can also be computationally intensive. | Human-robot collaboration, service robotics, and any application where a robot needs to operate safely in a human environment. Also promising for prosthetics and wearable robotics. |

Key Examples and Research Trends:

The development of e-skin is a highly interdisciplinary field, drawing on advances in materials science, electronics, and robotics. Researchers are exploring a wide range of materials and manufacturing techniques, from printed electronics to self-healing polymers [9]. A key trend is the development of "neuromorphic" e-skin, which is inspired by the human nervous system and can process tactile information in a more efficient and distributed manner [10]. While there are still significant challenges to overcome, the progress in this area is rapid, and we can expect to see e-skin playing an increasingly important role in robotics in the coming years.

References:

[9] Leogrande, E., et al. (2025). Electronic skin technologies: From hardware building blocks to system-level integration for robotics. Device, 100345.

[10] Liu, F., et al. (2022). Neuro-inspired electronic skin for robots. Science Robotics, 7(63), eabl7344.

D) What Tasks Tactile Already Wins (and Where It Still Struggles)

Figure 2: A comparison of the tasks where tactile sensing is already providing a clear advantage versus the areas where it continues to face significant challenges. This visualization highlights the current state of the art and the key frontiers for future research and development.

To make this analysis decision-useful, it is crucial to move beyond theoretical capabilities and examine where tactile sensing is already providing a clear, measurable advantage in real-world robotic applications. This section outlines the tasks where tactile sensing has demonstrated significant success, as well as the areas where it continues to face significant challenges.

Where Tactile Wins

1. Slip Detection and Grasp Stabilization

One of the most critical and well-established applications of tactile sensing is in the detection of slip and the subsequent stabilization of a robot's grasp. Tactile sensors can detect the subtle vibrations and changes in shear force that occur when an object begins to slip, allowing the robot to adjust its grip force in real-time to prevent the object from being dropped. This is a fundamental capability for any robot that needs to handle a variety of objects with different weights, shapes, and surface properties [11].

2. In-Hand Pose and Geometry Inference

Vision-based and other high-resolution tactile sensors can be used to accurately estimate the pose (position and orientation) of an object within the robot's hand. By analyzing the contact geometry between the sensor and the object, the robot can determine how the object is being held and adjust its grasp accordingly. This is particularly important for tasks that require precise object placement or manipulation, such as inserting a key into a lock or assembling electronic components [12].

3. Material and Texture Recognition

Tactile sensors can be used to identify and differentiate between different materials and textures. By analyzing the high-frequency vibrations and thermal properties of an object as it is touched, a robot can distinguish between materials such as wood, metal, and plastic. This capability is valuable for a wide range of applications, from sorting and recycling to providing a more nuanced and human-like interaction with the world [13].

4. Contact-Rich Assembly

Tactile sensing is a key enabler for the automation of contact-rich assembly tasks, such as inserting a peg into a hole or fastening a screw. These tasks are challenging for robots that rely solely on vision, as they require precise force control and the ability to detect and react to subtle contact cues. Tactile sensors provide the necessary feedback to guide the robot's movements and ensure that the task is completed successfully [14].

References:

[11] Veiga, F., et al. (2015). Stabilizing Novel Objects by Learning to Predict Tactile Slip. 2015 IEEE/RSJ International Conference on Intelligent Robots and Systems (IROS).

[12] Yoo, S. (n.d.). In-Hand Pose Estimation with Optical Tactile Sensor for Robotic Assembly. Siemens.

[13] Fishel, J. A., & Loeb, G. E. (2012). Material recognition using tactile sensing. 2012 4th IEEE RAS & EMBS International Conference on Biomedical Robotics and Biomechatronics (BioRob).

[14] Hogan, N. (1985). Impedance control: An approach to manipulation: Part I—Theory. Journal of Dynamic Systems, Measurement, and Control, 107(1), 1-7.

Where It Still Struggles

Despite the significant progress in recent years, there are still several major challenges that are hindering the widespread adoption of tactile sensing in robotics.

1. Long-Horizon Dexterous Manipulation Under Distribution Shift

While tactile sensing has shown promise in simple manipulation tasks, it is still very challenging for robots to perform long-horizon, dexterous manipulation tasks, especially when there is a significant shift in the distribution of objects and environmental conditions. This is because it is difficult to create models that can generalize from a limited set of training data to the vast range of objects and situations that a robot might encounter in the real world [15].

2. The Sim-to-Real Gap

The sim-to-real gap is a major challenge for all of robotics, but it is particularly acute for tactile sensing. This is because it is very difficult to accurately simulate the complex physics of contact-rich interactions. As a result, models that are trained in simulation often fail to transfer to the real world. This makes it difficult and expensive to develop and test new tactile sensing algorithms and systems [16].

3. Durability at Warehouse/Industrial Duty Cycles

Many tactile sensors are still not robust enough to withstand the rigors of industrial and warehouse environments. These sensors are often subjected to millions of cycles of contact, as well as to dust, dirt, and other contaminants. This can lead to a rapid degradation in performance and a high rate of failure. Developing tactile sensors that are both sensitive and durable is one of the most significant challenges facing the field [17].

References:

[15] Billard, A., & Kragic, D. (2019). Trends and challenges in robot manipulation. Science, 364(6446), eaat8414.

[16] Sferrazza, C., & D’Andrea, R. (2022). Sim-to-Real for High-Resolution Optical Tactile Sensing. 2022 International Conference on Robotics and Automation (ICRA).

[17] Dargahi, J., & Najarian, S. (2004). Human tactile perception as a standard for artificial tactile sensing—a review. The International Journal of Medical Robotics and Computer Assisted Surgery, 1(1), 23-35.

E) Research Map

To navigate the vast and rapidly evolving research landscape of tactile sensing, it is essential to anchor our analysis on a small number of high-signal surveys, curated resource lists, and key benchmark datasets. This section provides a map to the most important academic and open-source work in the field, drawing on the key resources identified in the initial feedback.

1. Curated Reading Lists and Surveys

The Awesome-Touch repository on GitHub has become the de facto central hub for the tactile sensing research community. It provides a comprehensive, curated list of papers, software, datasets, and other resources, organized by topic. This repository is an invaluable starting point for anyone looking to get up to speed on the latest developments in the field [18].

In addition to this community-curated resource, several excellent survey papers provide a high-level overview of the field. These papers are essential for understanding the key trends, challenges, and opportunities in tactile sensing.

References:

[18] Lin, C. (2022). Awesome-Touch. GitHub. Retrieved from https://github.com/linchangyi1/Awesome-Touch

2. Tactile Representation Learning

A key frontier in tactile sensing research is the development of learned representations that can capture the rich information contained in tactile data. The goal is to create models that can learn to extract meaningful features from raw sensor data, which can then be used for a variety of downstream tasks, such as object recognition, grasp stability prediction, and material classification.

The Touch100k dataset represents a major step forward in this area. It is a large-scale, multimodal dataset that includes over 100,000 paired touch, language, and vision data points. This dataset is enabling researchers to train powerful, touch-centric multimodal models that can learn to associate tactile sensations with both visual and linguistic descriptions. This is a critical step towards creating robots that can understand and interact with the world in a more human-like way [19].

References:

[19] Cheng, N., et al. (2024). Touch100k: A Large-Scale Touch-Language-Vision Dataset for Touch-Centric Multimodal Representation. arXiv:2406.03813.

3. Benchmarks for Active Tactile Perception

To drive progress in tactile sensing, it is essential to have standardized benchmarks that allow for the systematic evaluation and comparison of different algorithms and systems. The Tactile-MNIST benchmark is a significant step in this direction. It provides a suite of simulated tactile perception tasks, ranging from simple object localization to more complex classification and reconstruction challenges. This benchmark is designed to facilitate the development of learning-based active perception algorithms, which are essential for creating robots that can intelligently explore and understand their environment through touch [20].

By providing a common set of tasks and evaluation metrics, benchmarks like Tactile-MNIST are helping to accelerate the pace of innovation in tactile sensing and bring the field closer to solving the grand challenges of robotic manipulation.

References:

[20] Schneider, T., et al. (2025). Tactile MNIST: Benchmarking Active Tactile Perception. arXiv:2506.06361.

F) Data, Benchmarks, and Simulation

The development of advanced tactile sensing capabilities is critically dependent on the availability of high-quality data, standardized benchmarks, and accurate simulation tools. This section, often missing from investor-focused reports, is essential for understanding the true state of the field and the key drivers of progress.

1. Key Datasets

The availability of large-scale, high-quality datasets is a critical enabler for the development of learning-based approaches to tactile sensing. In recent years, there has been a significant increase in the number of publicly available tactile datasets, which are helping to drive progress in the field.

One of the most significant recent contributions is the VTDexManip dataset. This is a large-scale, vision-tactile dataset that was created by recording humans performing a variety of dexterous manipulation tasks. The dataset includes over 2,000 vision-tactile sequences, covering 10 different daily tasks and 182 different objects. This dataset is particularly valuable because it provides a rich source of data for training and benchmarking reinforcement learning algorithms for dexterous manipulation [21].

In addition to VTDexManip, there are a number of other important tactile datasets that are being used by the research community, including the Touch100k dataset (discussed in the previous section) and the ObjectFolder dataset. These datasets are providing the raw material for the development of a new generation of tactile-based robotic systems.

References:

[21] Liu, Q., et al. (2025). VTDexManip: A Dataset and Benchmark for Visual-tactile Pretraining and Dexterous Manipulation with Reinforcement Learning. International Conference on Learning Representations.

2. Active Tactile Perception Benchmarks

To ensure that active touch is evaluated in a consistent and rigorous manner, the research community has begun to develop standardized benchmarks for active tactile perception. These benchmarks are designed to test a robot's ability to intelligently explore and understand its environment through touch, and they are a critical tool for driving progress in this area.

The Tactile-MNIST benchmark, as mentioned in the Research Map, is a prime example of this effort. It provides a suite of simulated tasks that require a robot to actively explore an object to identify it. By providing a common set of tasks and evaluation metrics, this benchmark allows researchers to compare the performance of different active perception algorithms and to track progress over time [20].

These benchmarks are essential for moving the field beyond simple, reactive grasping and towards more sophisticated, intelligent manipulation.

3. Simulation Tools and the Sim-to-Real Gap

Accurate simulation of tactile sensing is a major challenge, but it is also a critical enabler for the development of learning-based approaches. In recent years, there has been significant progress in the development of simulation tools for tactile sensing, particularly for vision-based sensors like GelSight.

Tools like Taxim and Tacto are providing researchers with the ability to generate large amounts of synthetic tactile data, which can be used to train and test new algorithms without the need for expensive and time-consuming real-world experiments [22, 23]. These simulators are becoming increasingly realistic, but there is still a significant sim-to-real gap that needs to be addressed. This gap arises from the difficulty of accurately modeling the complex physics of contact, including the deformation of soft materials, the effects of friction, and the subtle changes in light that are used to generate the tactile image.

Bridging the sim-to-real gap is a major area of active research. The development of more accurate simulation tools, combined with techniques for domain adaptation and transfer learning, will be critical for unlocking the full potential of learning-based approaches to tactile sensing.

References:

[22] Si, Z., et al. (2022). Taxim: An Example-based Simulation Model for GelSight Tactile Sensors. 2022 International Conference on Robotics and Automation (ICRA).

[23] Wang, S., et al. (2020). Tacto: A Fast, Flexible, and Open-source Simulator for High-resolution, Vision-based Tactile Sensors. 2020 IEEE/RSJ International Conference on Intelligent Robots and Systems (IROS).

G) Company Landscape

The haptics market is a dynamic and rapidly evolving ecosystem, with a wide range of companies competing to develop the next generation of tactile sensing technologies. This section provides a detailed analysis of the key players in the market, organized by their primary focus area. For each company, we provide an overview of their product status, target customers, sensor modality, and any available evidence of their traction in the market.

| Company | Product Status | Target Customers | Sensor Modality | Deployment Evidence / Traction |

|---|---|---|---|---|

| XELA Robotics | Commercially available | Industrial automation, humanoid robotics, research | Magnetic | Customers include Honda, Hitachi, Samsung, Denso, Sanctuary AI, and Agile Robots. Integrations with Wonik Robotics, Sake Robotics, Weiss Robotics, and Robotiq. |

| GelSight | Commercially available | Industrial inspection, robotics research, quality control | Vision-based | Products include GelSight Mobile, GelSight Max, and the DIGIT sensor. Used by researchers at major universities and in a variety of industrial applications. |

| SynTouch | Commercially available | Haptics measurement, consumer product evaluation, robotics research | Biomimetic (multi-modal) | The BioTac sensor is used by a wide range of customers, including major automotive, consumer electronics, and apparel companies, to quantify the tactile properties of their products. |

| Shadow Robot Company | Commercially available | Robotics research, teleoperation, industrial automation | Vision-based (GelSight-style) and other tactile sensors | The Shadow Dexterous Hand is one of the most advanced robotic hands in the world. Used by researchers at NASA, ESA, OpenAI, Google Brain, and major universities. |

| Tacterion | Commercially available | Robotics, automotive, industrial HMI, consumer electronics | Capacitive/Resistive (plyon®) | The plyon® sensor technology is a flexible and stretchable sensor that can be used to create smart surfaces. Customers include Miele and other major industrial companies. |

| ATI Industrial Automation | Commercially available | Industrial automation, robotics, product testing | Strain gauge | A leading provider of force/torque sensors for a wide range of industrial and research applications. Their sensors are used by major robot manufacturers and in a variety of automated assembly and testing systems. |

| Tekscan | Commercially available | Medical, dental, industrial, and research | Piezoresistive | A leading manufacturer of thin-film pressure and force measurement sensors and systems. Their products are used in a wide range of applications, from dental occlusion analysis to battery pressure measurement. |

| Pressure Profile Systems (PPS) | Commercially available | Medical, industrial, robotics, consumer products | Capacitive | PPS provides tactile sensing solutions for a wide range of applications, including medical device testing, robotics, and consumer product design. Their sensors are known for their high resolution and sensitivity. |

| Contactile | Commercially available | Robotics, automation | Optical (3D deflection, force, vibration) | Developing tactile grippers that give robots a human-like sense of touch. Raised $2.5M and received government grants to commercialize their technology for robotic dexterity. |

| Bota Systems | Commercially available | Industrial automation, cobots, robotics research | 6-axis force/torque | A spin-off from ETH Zurich, Bota Systems develops a range of force/torque sensors for robotic applications. Their sensors are known for their compact design and high accuracy. |

| Robotiq | Commercially available | Industrial automation, manufacturing | Force/Torque | A leading provider of end-of-arm tooling for collaborative robots. Their FT 300-S force/torque sensor is widely used in industrial applications for force-sensitive tasks. |

H) Investment Thesis: Testable Hypotheses

Figure 3: A diagram illustrating the three testable hypotheses that form the core of our investment thesis. This visualization provides a clear and actionable framework for identifying and evaluating investment opportunities in the haptics market.

The haptics market is at an inflection point. After decades of slow and steady progress, the convergence of several key trends is creating a fertile environment for explosive growth. The core of our investment thesis is that the next generation of robotics, from autonomous warehouses to humanoid assistants, will be built on a foundation of advanced tactile sensing. Just as computer vision was the key enabling technology for the last wave of automation, we believe that haptics will be the defining technology of the next.

To make this thesis actionable, we can break it down into a series of testable hypotheses:

Hypothesis 1: Tactile foundation models will consolidate faster than sensor hardware.

The value in the haptics market will accrue to the companies that can build the best models, not the best hardware. Just as the value in the autonomous vehicle market has shifted from the car manufacturers to the software companies, we believe that the value in the haptics market will shift from the sensor vendors to the companies that can build the best tactile foundation models. This is because the data from tactile sensors is highly complex and requires sophisticated models to interpret. The companies that can build the best models will be able to extract the most value from this data, and they will be able to create a powerful software-based moat that will be difficult for competitors to replicate.

Hypothesis 2: Durability, not resolution, will be the gating factor for industrial adoption.

While high-resolution tactile sensors are impressive from a technical perspective, they are often too fragile and expensive for industrial applications. In the real world, durability is king. The companies that can develop robust, reliable, and cost-effective tactile sensors that can withstand the rigors of an industrial environment will be the ones that win the market. This is because the cost of downtime in a factory or warehouse is so high that companies are willing to trade off a certain amount of performance for a higher degree of reliability.

Hypothesis 3: Vertical integration wins before horizontal standardization.

In the early stages of a new market, the companies that are able to offer a complete, end-to-end solution are often the most successful. This is because they are able to solve the entire problem for the customer, from the sensor to the software to the system integration. As the market matures, we expect to see a shift towards horizontal standardization, with different companies specializing in different parts of the stack. However, in the near term, we believe that the companies that are able to offer a vertically integrated solution will be the ones that are best positioned to capture the market.

Appendix: Market Sizing and Projections

The following market sizing data is provided for context. As noted in the main body of the report, these figures should be treated with caution, as they are based on a variety of sources and methodologies. The true market opportunity for haptics is likely to be significantly larger than these projections suggest, as they do not fully account for the new markets that will be unlocked by the development of advanced tactile sensing capabilities.

- Haptics and Tactile Sensing Market: Market analyses consistently project a compound annual growth rate (CAGR) for haptics and tactile sensing technologies in the range of 13% to 16% [2, 3, 4, 5, 6, 7].

- Overall Robotics Market: The overall robotics market is expected to more than double by 2030, with some analysts projecting a market size of over $200 billion [8, 9].

References:

[2] Grand View Research. (n.d.). Haptic Devices Market Size, Share And Growth Report, 2030.

[3] Mordor Intelligence. (n.d.). Haptic Technology Market Size, Share & 2030 Trends Report.

[4] Strategic Market Research. (n.d.). Haptic Technology Market Size ($8.7 Billion) 2030.

[5] Mordor Intelligence. (2025, August 6). Tactile Sensor Market Size, Share & 2030 Trends Report.

[6] GM Insights. (n.d.). Tactile Sensors Market Size, Growth Opportunity 2025-2034.

[7] Fortune Business Insights. (n.d.). Tactile Sensor Market Size, Share, Growth & Forecast 2034.

[8] ABI Research. (n.d.). The Global Robotics Market Outlook.

[9] RoboticsTomorrow. (2024, September 18). Robotics industry will be worth $218 billion in 2030, forecasts GlobalData.

I) The “Why Now” Synthesis: A Market Inflection Point

Figure 4: A timeline illustrating the historical barriers that have stalled the progress of haptics and the recent breakthroughs that have created a market inflection point. This visualization provides a clear and concise answer to the “why now” question.

For the past three decades, advanced tactile sensing has been a technology that was perpetually “just around the corner.” Despite its theoretical importance, it failed to achieve widespread commercial adoption. However, a confluence of recent technological and market shifts has created a powerful “why now” moment, transforming haptics from a speculative research area into an inevitable and critical component of the next generation of robotics.

Why Haptics Stalled Historically

Understanding the current opportunity requires an honest assessment of past failures. The commercial scaling of haptics was historically impeded by four primary factors:

- Fragile and Expensive Sensors: Early tactile sensors were often delicate, unreliable, and prohibitively expensive for all but the most specialized applications. They could not withstand the rigors of industrial environments, and their cost made them a non-starter for mass-market products.

- Lack of Learning Leverage: In the era of rule-based robotics, the rich, high-dimensional data from tactile sensors was more of a curse than a blessing. Without the tools to effectively process this data, engineers were forced to rely on simpler, more reliable sensor modalities.

- Absence of Datasets and Benchmarks: The robotics community lacked the large-scale, standardized datasets and benchmarks that were needed to drive progress in tactile perception. This made it difficult to compare different approaches, measure progress, and train the data-hungry learning models that have proven so successful in other domains.

- Integration Cost Outweighed Marginal Benefit: For many applications, the marginal benefit of adding tactile sensing was not worth the significant cost and complexity of integrating it into a robotic system. Vision and force/torque sensing were often “good enough” to solve the problem at hand.

What Changed in the Last 3-5 Years

The landscape has now fundamentally changed. Four key developments have converged to unlock the potential of haptics:

- End-to-End Learning Benefits from Tactile Gradients: The rise of deep learning and end-to-end robotic learning has created a powerful new paradigm for robotic control. These models can directly benefit from the rich, high-dimensional data provided by tactile sensors, using it to learn complex, contact-rich manipulation skills that were previously impossible.

- Multimodal Foundation Models Make Tactile Reusable: The emergence of large-scale, multimodal foundation models is a game-changer for haptics. These models can fuse data from multiple sensor modalities, including vision, language, and touch, to create a more holistic understanding of the world. This makes tactile data more valuable and reusable across a wider range of tasks and applications.

- Commoditization of Enabling Hardware: The cost of key enabling technologies, such as cheap cameras, MEMS sensors, and flexible electronics, has plummeted in recent years. This has made it possible to build sophisticated, multi-modal tactile sensors at a price point that is viable for mass-market applications.

- Dexterity is Now the Binding Constraint: As progress in robotic perception and control has accelerated, dexterity has become the primary bottleneck for a wide range of applications. The ability to grasp, manipulate, and interact with a wide variety of objects in unstructured environments is now the key differentiator for the next generation of robotic systems, and this is a problem that can only be solved with advanced tactile sensing.

This confluence of trends has created a powerful, self-reinforcing cycle. As more robots are equipped with tactile sensors, more data is generated, which in turn fuels the development of more powerful learning models, which in turn drives the demand for more advanced tactile sensors. This is the virtuous cycle that will drive the exponential growth of the haptics market in the years to come.

J) Diagnostic Company Classification: From Description to Decision

The company landscape table in Section G provides a descriptive overview of the key players in the haptics market. However, from an investment perspective, it is crucial to move beyond description and develop a diagnostic framework that can differentiate between companies with venture-scale potential and those that are likely to remain niche players. This section introduces a second-order classification that categorizes companies based on their business model and market focus.

The Four Quadrants of the Haptics Market

Figure 5: A strategic positioning map of the key players in the haptics market, organized by their business model and market focus. This visualization provides a diagnostic framework for differentiating between companies with different growth trajectories and investment profiles.

We can classify the companies in the haptics market into four primary quadrants:

- Research Tooling: Companies in this quadrant are primarily focused on providing tools and components to researchers and academics. They are often the first to commercialize new technologies, but their market is limited by the size of the academic research community.

- Component Vendors: These companies provide a specific component or subsystem that is integrated into a larger product. They can be highly successful and profitable, but their growth is ultimately tied to the success of their customers.

- System Integrators: These companies build complete, end-to-end solutions for a specific application or vertical market. They have the potential to capture a significant share of the value chain, but they also face the challenge of building and supporting a complex, integrated system.

- Horizontal Platforms: The holy grail of the haptics market is the creation of a horizontal platform that can be used across a wide range of applications and industries. This is the most difficult and capital-intensive path, but it also has the potential to generate the largest returns.

Scored Comparison Matrix

Figure 6: A heatmap visualizing the scored comparison of key haptics companies across the six evaluation criteria. This provides a quantitative and at-a-glance assessment of the competitive landscape.

To further refine our analysis, we can use the evaluation rubric from Section C to score a representative set of companies on a scale of 1 to 5 (where 1 is low and 5 is high) across the key dimensions of our framework. This provides a quantitative and decision-relevant comparison of the different players in the market.

| Company | Signal Richness | Mechanical Robustness | Integration Burden | Manufacturability/Cost | Learning Leverage | Customer Pull | Overall Score |

|---|---|---|---|---|---|---|---|

| GelSight | 5 | 2 | 2 | 3 | 5 | 4 | 3.5 |

| XELA Robotics | 4 | 5 | 3 | 4 | 4 | 5 | 4.2 |

| SynTouch | 4 | 4 | 3 | 3 | 4 | 3 | 3.5 |

| Shadow Robot | 5 | 3 | 2 | 2 | 5 | 3 | 3.3 |

| Tacterion | 3 | 4 | 4 | 4 | 3 | 4 | 3.5 |

| ATI | 2 | 5 | 4 | 4 | 2 | 5 | 3.7 |

| Tekscan | 2 | 3 | 4 | 5 | 2 | 4 | 3.3 |

| Contactile | 4 | 3 | 3 | 3 | 4 | 3 | 3.3 |

Disclaimer: This scoring is based on publicly available information and is intended to be a high-level, illustrative analysis. A full investment decision would require a much deeper and more detailed due diligence process.

K) Common Failure Patterns: Where Tactile Fails to Deliver ROI

An honest assessment of any technology requires a clear-eyed view of its limitations and failure modes. While the potential of advanced tactile sensing is immense, its practical application is often fraught with challenges that can undermine its value proposition. This section presents three anonymized, literature-based case studies that illustrate the most common failure modes for tactile sensing in real-world deployments. These negative examples are critical for developing a nuanced and realistic investment thesis.

Failure 1: The Over-Engineered Gripper (Failure to Justify Cost)

Scenario: A high-volume e-commerce fulfillment center was looking to automate the picking of a wide variety of items, from soft polybags to rigid boxes. A robotics vendor proposed a solution that included a state-of-the-art, high-resolution capacitive tactile gripper. The gripper was designed to provide a rich, detailed map of the contact surface, enabling the robot to perform delicate, human-like grasps.

Outcome: In a controlled lab environment, the tactile gripper demonstrated a 5% improvement in grasp success rate compared to a simpler, vision-guided gripper with a basic force/torque sensor. However, the tactile gripper was more than double the cost of the simpler system. When deployed in the fulfillment center, the marginal improvement in grasp success was not sufficient to justify the significant increase in cost. The company ultimately opted for the simpler, more cost-effective solution, concluding that the additional data provided by the tactile sensor was not worth the price.

Lesson: For many applications, a “good enough” solution that is cheap and reliable will win out over a more advanced, but more expensive, solution. The value of additional tactile data must be weighed against the cost of acquiring it.

Failure 2: The Warehouse Wear-Out (Durability Killed ROI)

Scenario: A robotics startup developed a novel, soft, vision-based tactile sensor that promised to provide a human-like sense of touch. The sensor was integrated into a robotic hand and deployed in a pilot program at a major logistics company. The goal was to demonstrate the sensor’s ability to handle a wide variety of objects in a high-throughput warehouse environment.

Outcome: The sensor performed well in initial testing, demonstrating impressive dexterity and sensitivity. However, after several weeks of continuous operation, the soft, elastomeric surface of the sensor began to show signs of wear and tear. The sensor’s performance degraded, and it eventually failed completely. The cost of replacing the sensor, combined with the downtime of the robotic system, made the solution economically unviable. The logistics company concluded that the sensor was not yet robust enough for the rigors of a real-world warehouse environment.

Lesson: Durability is a critical and often overlooked factor in the success of any tactile sensing technology. A sensor that cannot withstand millions of cycles of contact in a harsh industrial environment will never achieve widespread adoption, no matter how sensitive or sophisticated it is.

Failure 3: The “Good Enough” Vision System (Vision + F/T as a Viable Alternative)

Scenario: A manufacturer of consumer electronics was looking to automate the assembly of a new product. The task involved inserting a flexible cable into a small connector, a classic example of a contact-rich manipulation task. A number of robotics vendors proposed solutions that included advanced tactile sensors.

Outcome: After a thorough evaluation, the manufacturer opted for a solution that used a combination of high-resolution vision and a wrist-mounted force/torque sensor. The vision system was used to precisely align the cable with the connector, and the force/torque sensor was used to monitor the insertion force and detect any anomalies. This simpler, more cost-effective solution was able to achieve the required level of performance without the need for a more complex and expensive tactile sensor.

Lesson: For many tasks, a combination of vision and force/torque sensing can be a “good enough” alternative to a more advanced tactile sensor. The decision of whether or to add a tactile sensor must be based on a careful analysis of the specific task requirements and the trade-offs between performance, cost, and complexity.

Appendix L: Company Profiles

This appendix provides detailed profiles of key companies in the haptics and tactile sensing ecosystem, including established players and emerging startups. Each profile includes information on funding, investors, technology, and market focus, where available.

Established Players

GelSight

GelSight Mini tactile sensor. Source: GelSight

Founded in 2011 as a spin-out from the Massachusetts Institute of Technology (MIT), GelSight is headquartered in Waltham, Massachusetts. The company has raised between $18-30 million in total funding across multiple rounds, with key investors including Anzu Partners (who led the Series B), Scout Ventures, the National Science Foundation, Hexagon, and Omega Funds. GelSight's estimated annual revenue is $4-5 million.

GelSight's core technology uses an elastomeric gel with embedded markers and a camera to create high-resolution 3D maps of any surface it touches. This vision-based approach allows robots and inspection tools to "see" with a sense of touch, capturing detailed texture and surface geometry at sub-micron resolution. Their products include the GelSight Mini for portable surface inspection, the GelSight Mobile for field metrology, and the Digit sensor for robotics research. Target markets include industrial metrology, quality inspection, and robotics research.

Website: gelsight.com

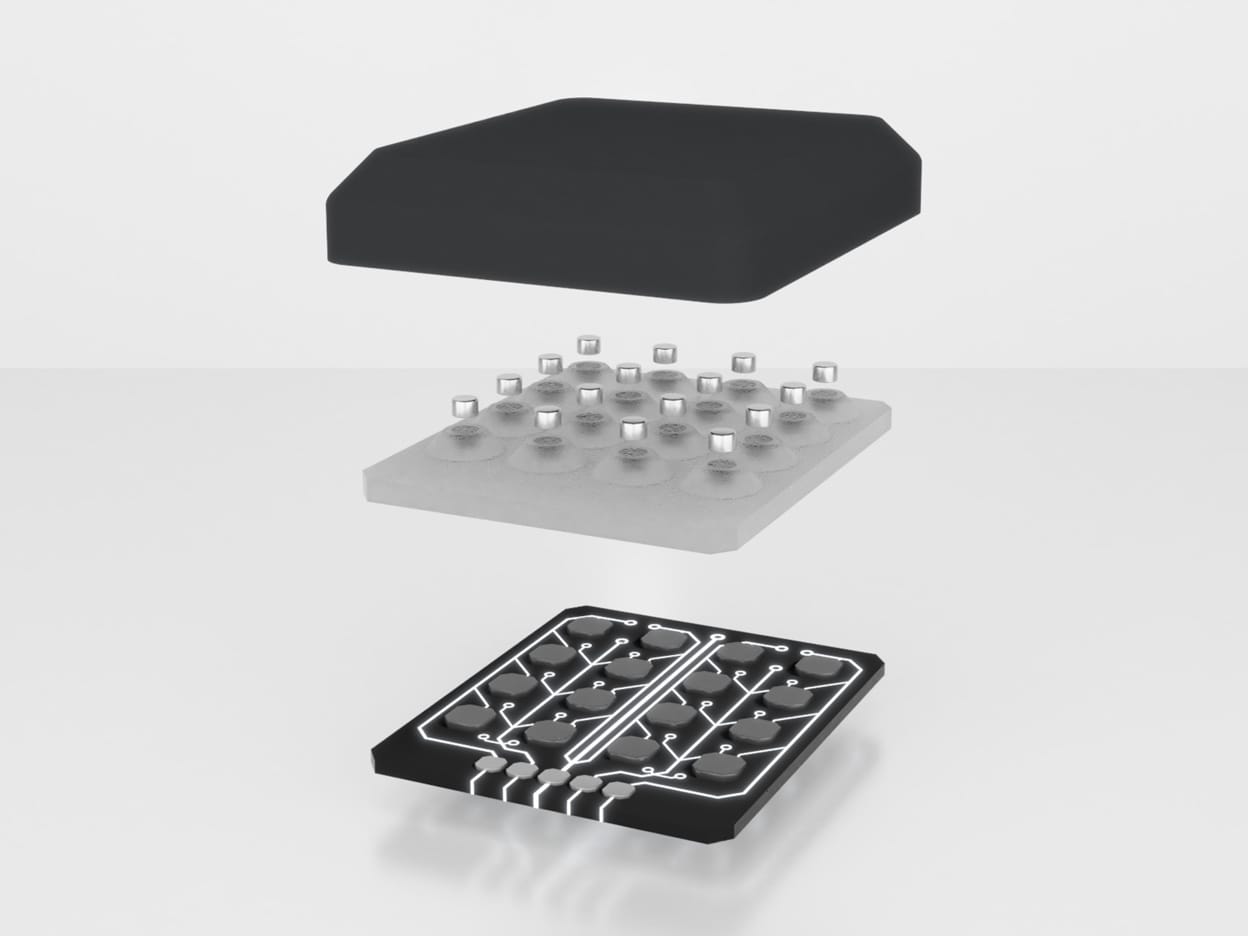

XELA Robotics

XELA Robotics uSkin tactile sensor array. Source: XELA Robotics

A spin-out from Waseda University in Tokyo, XELA Robotics specializes in high-density 3-axis magnetic tactile sensors. The company has received early-stage funding from investors including Rogers Investment Advisors, HAX Tokyo, Berkeley SkyDeck, FIVESTAR Capital Partners, and Forge (Japan). Revenue is estimated at less than $5 million.

XELA's flagship product is the uSkin sensor, which uses magnetic sensing to measure 3-axis forces across a flexible, thin, and durable sensor array. This technology enables robots to sense object shape, texture, and even temperature, providing a human-like sense of touch. The sensors are designed to minimize wiring requirements and can be customized for different robotic hand and gripper configurations. XELA focuses on humanoid robots and industrial robot hands, with integrations available for products from Wonik Robotics, Sake Robotics, and Robotiq.

Website: xelarobotics.com

SynTouch (Dissolved)

SynTouch BioTac biomimetic tactile sensor. Source: SynTouch

SynTouch, founded in 2008 and headquartered in Los Angeles, California, was a pioneer in biomimetic tactile sensing. The company raised funding over six rounds from investors including Ben Jen Holdings, Checkmate Capital, Comet Labs, DL Capital (Shanghai), and iXcelio. Historical revenue was estimated at approximately $13.5 million.

SynTouch's flagship product was the BioTac sensor, designed to mimic the human fingertip with the ability to sense force, vibration, and temperature simultaneously. The sensor used a fluid-filled elastomeric skin over a rigid core, with embedded electrodes to detect deformation. This multimodal approach allowed robots and prosthetics to perceive objects with human-like sensitivity. While SynTouch was a leader in the research market and had a significant impact on the field, the company was dissolved in late 2024. Its legacy continues to influence the development of multimodal tactile sensors.

Website: (Dissolved)

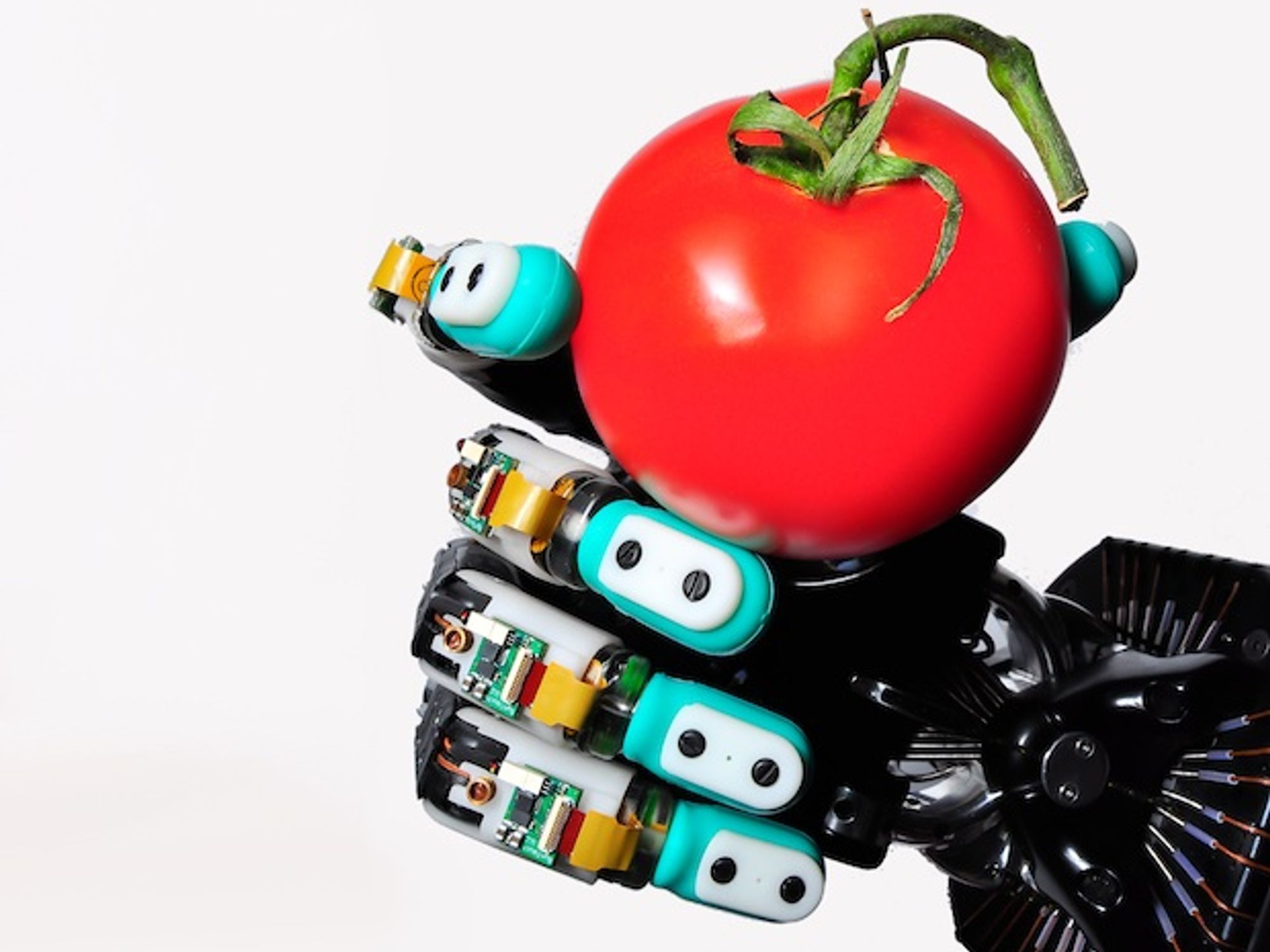

Shadow Robot Company

Shadow Dexterous Hand. Source: Shadow Robot Company

Shadow Robot Company, founded in 1987, is Britain's longest-running robotics company. Based in London (Gospel Oak), the company is employee-owned with a team of 36 across the UK and Spain. Shadow Robot has been primarily grant-funded, with support from Innovate UK, the European Union, and 39 angel investors. In 2019, the company received a £650,000 UK government loan, and in 2025, it was awarded funding for ARIA projects. Revenue is estimated at $7-15 million.

Shadow Robot is known for its highly advanced dexterous robotic hands, which feature 24 degrees of freedom and can replicate the full range of human hand movements. The company also develops teleoperation systems that allow humans to remotely control robotic hands with high fidelity. Their products are used in research, nuclear, space, and other hazardous environments where remote manipulation is required.

Website: shadowrobot.com

Tacterion

Tacterion SensorSkin. Source: Tacterion

A 2015 spin-off from the German Aerospace Center (DLR), Tacterion is headquartered in Munich, Germany. The company completed a Series A funding round in 2021, led by Miele Venture Capital, with participation from Unger Capital Management, TechFounders, and the Helmholtz Association.

Tacterion develops capacitive e-skin and flexible tactile sensors under the SensorSkin brand. Their technology uses a stretchable, flexible substrate with embedded capacitive sensing elements to detect touch, pressure, and proximity. This enables smart surfaces and interactive products, with applications in consumer goods (including partnerships with Miele), automotive, and robotics. By providing a sense of touch to everyday objects, Tacterion is helping to create the tactile internet of the future.

Website: tacterion.com

ATI Industrial Automation

ATI Industrial Automation is headquartered in Apex, North Carolina, and was founded in 1989. The company was acquired by Novanta in 2019 for $172 million and is now part of Novanta's $700+ million revenue portfolio.

ATI is a global leader in force/torque sensors and robotic tool changers. Their Multi-Axis Force/Torque Sensor Systems (including the Axia, Gamma, Mini, and Nano series) are the industry standard for robotic force control applications. These sensors use strain gauge technology to measure forces and torques in six degrees of freedom with high accuracy and repeatability. ATI's products are used in industrial automation, robotics, aerospace, and research.

Website: ati-ia.com

Tekscan

Tekscan, founded in 1987 and headquartered in South Boston, Massachusetts, is a privately held company and an industry leader in thin-film pressure mapping and force sensing technology.

Tekscan's products use proprietary thin-film resistive sensors to measure force and pressure distribution between nearly any two surfaces. Their product line includes FlexiForce sensors (single-point force measurement), I-Scan (pressure mapping for industrial applications), and specialized systems for medical, dental, and biomechanics applications. Tekscan's technology helps customers optimize product designs and enhance clinical and research outcomes.

Website: tekscan.com

Pressure Profile Systems (PPS)

Pressure Profile Systems, founded in 1996 and headquartered in Los Angeles, California, specializes in capacitive tactile array sensors for haptic measurement and mapping.

PPS offers a range of sensor systems for healthcare, robotics, consumer products, and education. Key products include DigiTacts (tactile sensors for robotic grippers), FingerTPS (for quantifying human touch), TactArray (for pressure distribution mapping), and Chameleon (wearable pressure sensor gloves for robotics, VR, and gaming). PPS is known for its expertise in capacitive sensing and has published detailed technical resources on the strengths and limitations of this technology.

Website: pressureprofile.com

Bota Systems

Bota Systems is an ETH Zurich spin-off headquartered in Zurich, Switzerland. The company raised a $2.5 million seed round in October 2023, led by Marathon Venture Capital, with participation from StraightWalk, ESA BIC Switzerland, Venture Kick, and Kickstart.

Bota Systems develops highly integrated 6-axis force/torque sensors with built-in electronics, integrated IMU, and inertia compensation. Their products, including the SensONE, MiniONE, and MedONE, are designed for easy integration with robotic arms and are used in industrial robotics, research, and medical applications. The company's sensors are manufactured in Switzerland and are known for their compact design and precision.

Website: botasys.com

Robotiq

Robotiq, founded in 2008 and headquartered in Lévis, Quebec, Canada, was acquired by Teradyne in 2022.

Robotiq is a leading provider of adaptive grippers and force sensing solutions for collaborative robots. Their products, including the 2F-85 and 2F-140 grippers, the Hand-E gripper, and the FT 300 force/torque sensor, are designed for easy integration with cobots from Universal Robots and other manufacturers. Robotiq's grippers feature adaptive fingers that can handle a wide range of object shapes and sizes, while their force sensors enable force-controlled applications like polishing and assembly.

Website: robotiq.com

Startups & Emerging Players

TACTA Systems

TACTA Systems, founded in 2023 and headquartered in Palo Alto, California, is a well-funded startup with a mission to develop the "nervous system for robots." The company has raised $75 million in combined seed ($11 million, led by Matter Venture Partners) and Series A ($64 million, led by Woven Capital) funding. Other investors include America's Frontier Fund, SBVA, B Capital, Sojitz Corporation, and CDIB Capital.

TACTA's Dextrous Intelligence platform integrates tactile sensors, customized edge AI chips, and proprietary dextrous models into a cohesive system. This approach enables robots to perform delicate, variable, human-like tasks with flexibility, efficiency, and autonomy. With a focus on humanoid robots and industrial automation, TACTA is positioned to be a major player in the emerging physical AI market.

Website: tactasystems.com

Contactile

Contactile, founded in 2019 as a spin-out from the University of New South Wales (UNSW), is headquartered in Sydney, Australia. The company raised $2.5 million in seed funding in May 2022, led by True Ventures, and received a $268,712 federal commercialization grant in 2025.

Contactile develops biomimetic tactile sensors under the PapillArray brand. These sensors are inspired by the structure of human fingertips and can measure 3D displacement, 3D force, and vibration on each sensing element, as well as global force and torque. Contactile's sensors enable intelligent robotic handling and manipulation for real-world applications, with a focus on industrial robotics and research.

Website: contactile.com

Sensetics

Sensetics, a spin-out from UC Berkeley, is headquartered in Princeton, New Jersey. The company raised $1.75 million in pre-seed funding in November 2025, led by MetaVC Partners.

Sensetics is developing a platform for digitizing, editing, and transmitting tactile data. Their technology uses programmable fabrics and AI-powered touch capture software to enable real-time recording and transmission of tactile data from devices such as robotic arms, surgical tools, wearables, and remote sensors. Sensetics sees a market opportunity exceeding $10 billion across industries where force sensing and haptic feedback are fundamental to performance.

Website: sensetics.ai

Xense Robotics

Xense Robotics, established in May 2024 and headquartered in Shanghai, China, focuses on multimodal tactile perception and intelligent technology for precise robotic operations. The company recently raised tens of millions of yuan in angel funding.

The founder, Dr. Ma Daolin, holds a PhD from Peking University and completed postdoctoral research on robotic manipulation and tactile perception at MIT's Mcube lab. Xense Robotics is developing advanced tactile sensors for humanoid robots and industrial manipulation applications.

Website: xenserobotics.com

Tashan

Tashan, founded in 2017, is a Chinese company focused on AI tactile sensing chips and application solutions. The company is backed by research teams from Tsinghua University and the University of Manchester.

Tashan has filed 172 patents, including 40 core patents related to humanoid robots. The company developed the world's first mixed-signal AI haptic chip, which is used in fingertip tactile sensors and electronic skins. Tashan has partnerships with renowned companies like Xiaomi, Mercedes-Benz, and BMW.

PaXiniTech

PaXiniTech is a Chinese company with core technology from the robotics lab at Waseda University in Japan. The company specializes in multidimensional tactile technology, developing high-sensitivity tactile sensors with skin-like properties.

PaXiniTech's product lines include tactile sensor modules, robot joint modules, and humanoid robots. Their sensors are designed to provide robots with a human-like sense of touch for delicate manipulation tasks.

New Degree Technology (NDT)

New Degree Technology (NDT), founded in 2011 as a Sino-foreign joint venture, focuses on pressure-sensitive touch technology and offers integrated force-sensing touch solutions.

NDT's robot tactile sensors are based on piezoresistive principles, detecting the magnitude and position of forces through slight sensor deformation and Wheatstone bridge differential signal output. The sensors are known for high sensitivity, easy installation, and durability, and are widely used in robotics.

Novasentis

Novasentis is dedicated to developing thin-film tactile sensors, widely used in augmented reality (AR/VR), wearable devices, sports training equipment, and gaming controllers.

Novasentis's thin-film sensors are known for their sensitivity and flexibility, making them suitable for applications where form factor and weight are critical.

BeBop Sensors

BeBop Sensors develops smart fabric sensor solutions for OEMs. The company has raised $14.4 million across 2 funding rounds.

BeBop's technology uses conductive fabrics and proprietary algorithms to create flexible, durable sensors that can be integrated into a wide range of products, from automotive seats to gaming controllers and medical devices.

Website: bebopsensors.com

- GelSight Company Profile - Crunchbase

- XELA Robotics Company Profile - Tracxn

- SynTouch Dissolution Announcement - LinkedIn

- Shadow Robot Company Profile - Tracxn

- Tacterion Series A Announcement

- TACTA Systems $75M Funding Announcement - PR Newswire

- Contactile Seed Funding Announcement - PR Newswire

- Bota Systems Seed Round Announcement

- Sensetics Pre-Seed Funding - PR Newswire

- Global Overview of Tactile Sensor Companies - CMRA

Written by Bogdan Cristei, Claude & Manus AI