DeepTech Pulse Vol. 3: The Physical AI Revolution and the Great Power Recalibration

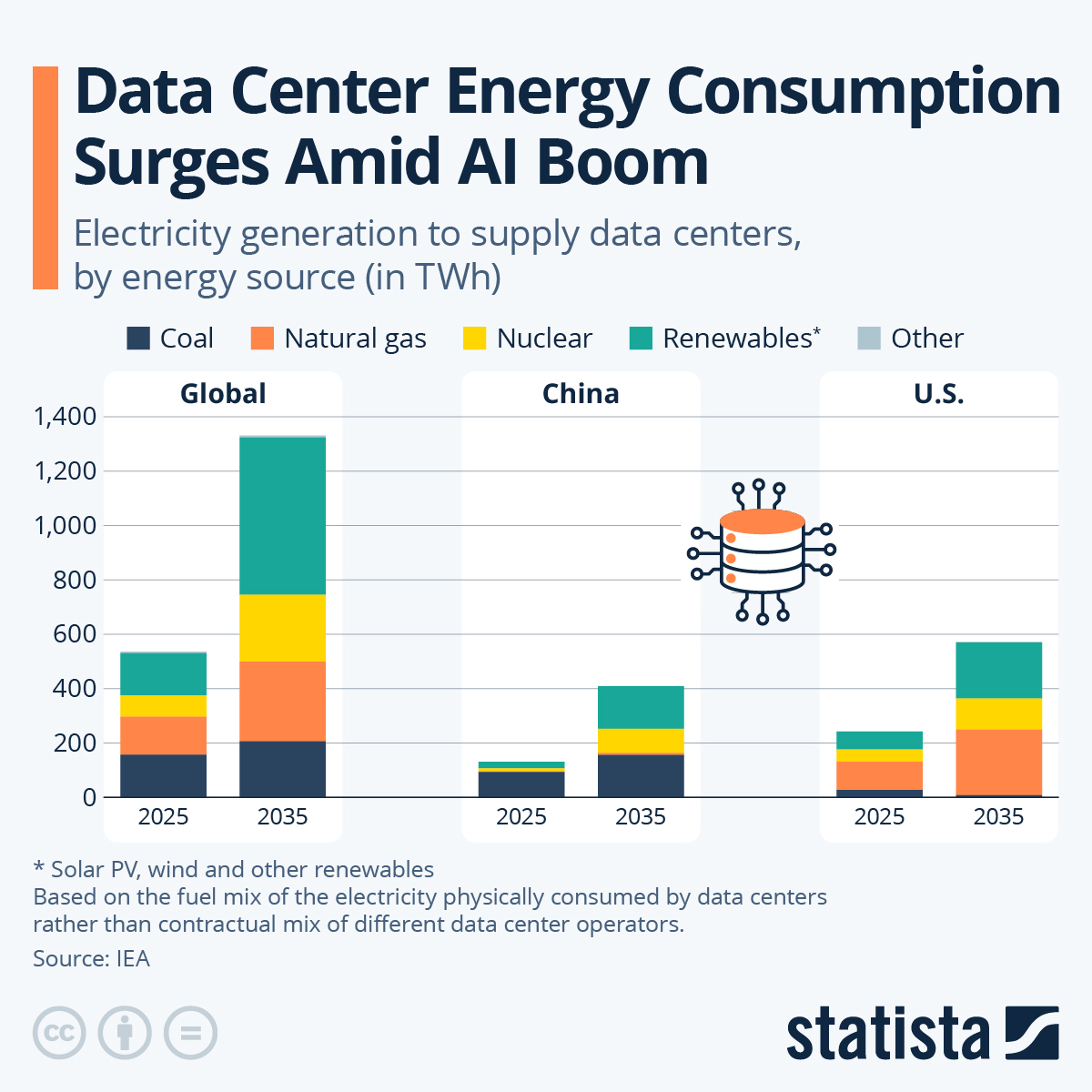

Figure 1: Data center energy consumption surges amid the AI boom, with dramatic increases projected through 2030

Executive Summary: As we enter the latter half of 2025, the deep tech landscape is undergoing a seismic transformation defined by two powerful, intersecting currents: the undeniable rise of physical AI and a looming energy crisis that threatens to bottleneck its progress. This issue of DeepTech Pulse unpacks the critical developments shaping our transition from a software-first world to one of embodied intelligence, where the physical world is the new frontier. We examine the monumental funding rounds fueling the robotics boom, the strategic recalibration of venture capital, and the intensifying technological competition between the US and China. From the data centers' insatiable hunger for power to the philosophical debate between humanoid and morphology-agnostic robotics, we are witnessing a new industrial age where infrastructure is intelligence, and the future belongs to those who can master the world of atoms, not just bits.

The New Oil and the New Code: AI's Insatiable Thirst for Power

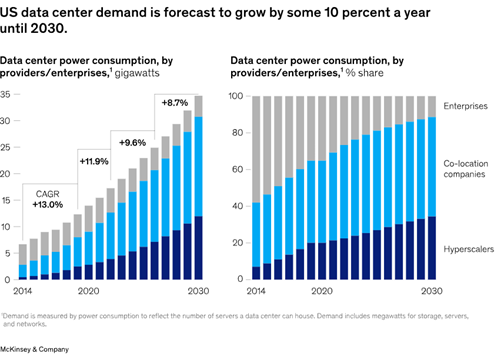

Figure 2: Projected growth in AI data center power consumption showing exponential demand increases

The artificial intelligence boom, for all its digital glory, is colliding with a hard physical reality: an impending energy crisis. As Cameron McLain of Giant Ventures aptly puts it, "AI's biggest bottleneck isn't algorithms — it's power" [1]. This isn't a distant concern; it's a present-day challenge reshaping the economics of AI and elevating energy to the status of a strategic moat. The smartest AI companies are beginning to look like utilities, and the race is on to secure cheap, clean, and reliable power.

The numbers are staggering. Goldman Sachs forecasts a 165% increase in global power demand from data centers by 2030 compared to 2023 levels [2]. The International Energy Agency projects that AI-related electricity consumption alone will grow by as much as 50% annually from 2023 to 2030 [3]. In the US, data centers are on track to consume nearly 12% of the nation's power [4]. This insatiable demand is forcing a radical rethinking of AI infrastructure, from the data center to the grid itself.

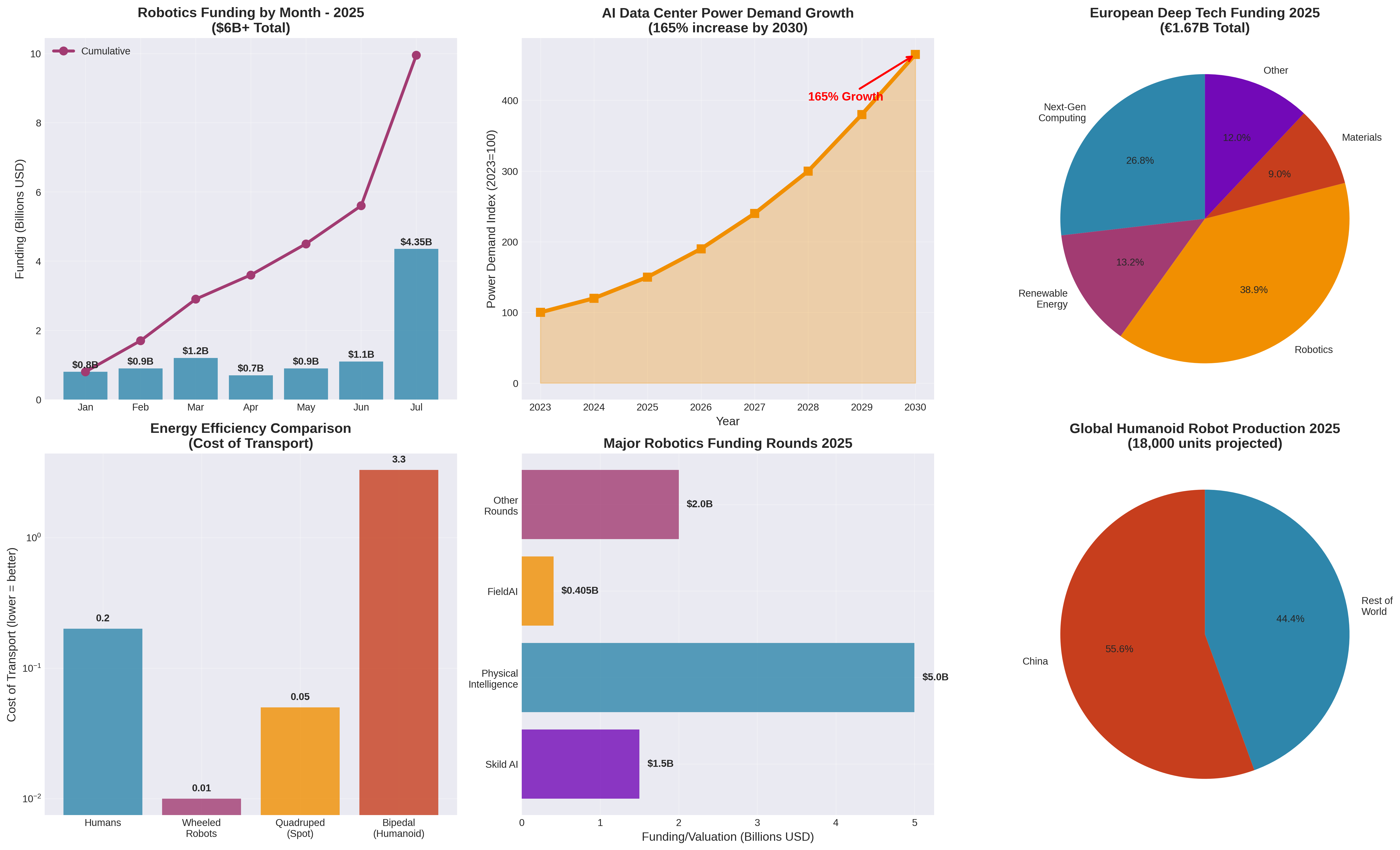

Figure 3: Comprehensive data analysis showing robotics funding trends, energy efficiency comparisons, and market dynamics

In response, we're seeing a surge of innovation in energy generation and management. Giant Ventures' portfolio highlights this trend, with investments in companies like Radiant (portable nuclear reactors), Flower, Haven Energy, and Elvy (grid flexibility for renewables) [1]. The convergence of AI and energy is also giving rise to what McLain calls "symbiotic models," where infrastructure startups vertically integrate with AI demand, and builders become their own best customers [1].

The public sector is also taking notice. The U.S. Department of Energy is actively seeking proposals for AI data centers to be co-located with energy projects at Idaho National Laboratory, a clear signal of the strategic importance of this issue [5]. Meanwhile, a landmark deal between Google, Kairos Power, and the Tennessee Valley Authority will supply 50 megawatts of advanced nuclear power to data centers in Tennessee and Alabama, a move that could set a precedent for the industry [6].

This energy crunch is not just about building more power plants. It's about building smarter. AI itself can be a powerful tool for optimizing energy consumption, with data centers shifting workloads to off-peak hours and leveraging energy storage to balance the grid [7]. However, the scale of the challenge is immense. As one report notes, modern AI data centers can consume as much electricity as a small city, with memory and cooling systems adding significantly to the power draw [8]. As McLain concludes, "Energy is the new oil and the new code. Physical innovation is the unlock" [1].

Physical AI and the Robotics Gold Rush

Figure 4: Physical Intelligence's general AI robot represents the cutting edge of morphology-agnostic robotics

While the world remains captivated by the rapid advancements in large language models, a new frontier is emerging with even greater potential to reshape our physical world: robotics. As Jim Fan, Director of AI at NVIDIA, eloquently states, "The GPT-1 of robotics is already somewhere on Arxiv, but we don't know exactly which one" [9]. This sentiment captures the excitement and uncertainty of a field on the cusp of a major breakthrough. The debates are heated, the entropy is high, and the ideas are wildly creative, reminiscent of the early days of NLP before ChatGPT's dominance.

The investment landscape reflects this enthusiasm, with a veritable gold rush into robotics startups. In the first seven months of 2025 alone, investors poured $6 billion into the sector, with Crunchbase predicting a record-breaking year [10]. July 2025 saw a staggering $4.35 billion invested across 93 funding rounds [11]. This isn't just a US phenomenon; European robotics startups have also seen a surge in funding, raising €648 million in 2025, a significant increase from the previous year [12].

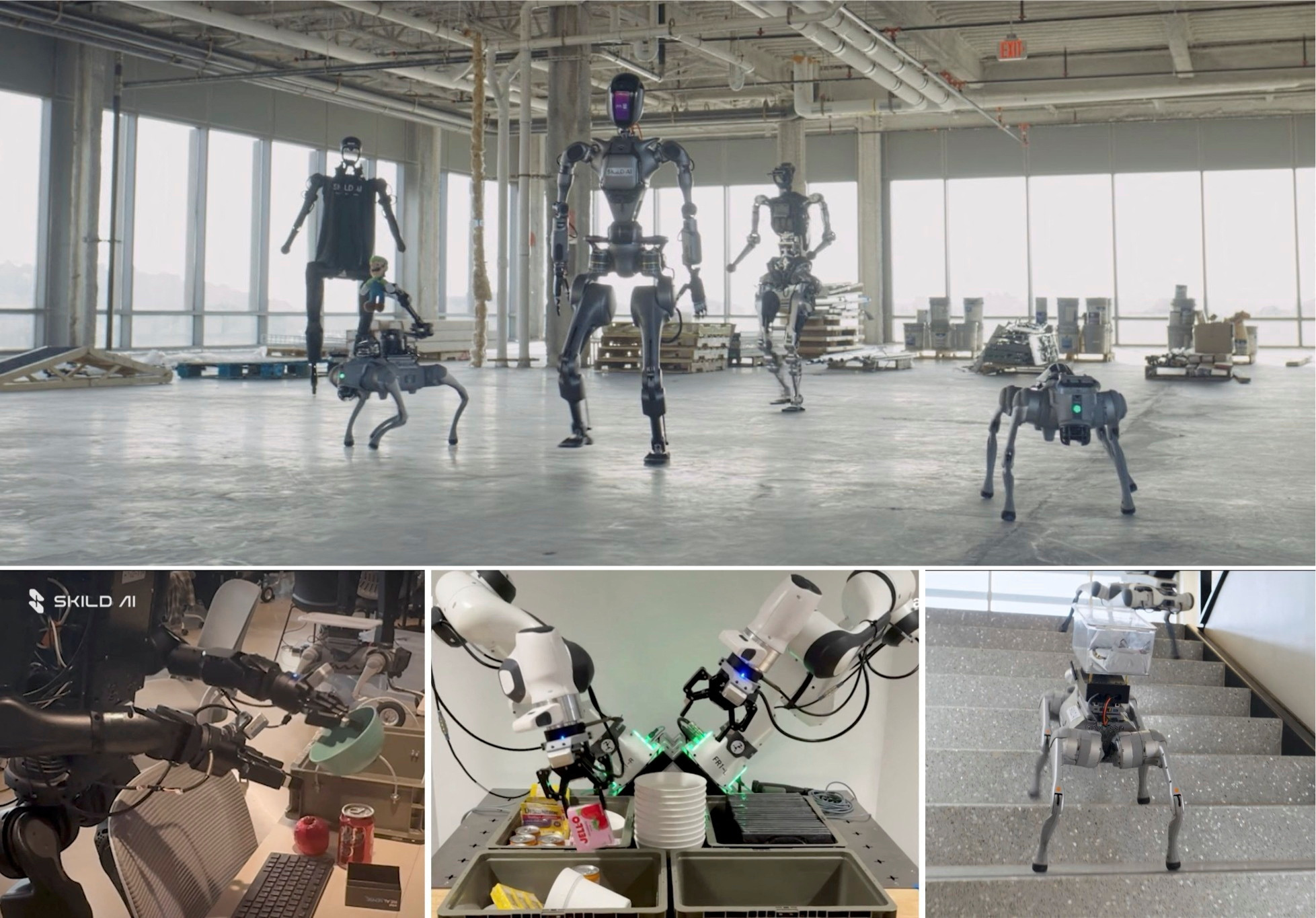

Figure 6: Skild AI's general-purpose robot brain represents a $1.5B bet on shared intelligence across robot platforms

At the heart of this boom is the rise of "Physical AI," a new paradigm that aims to create general-purpose intelligence for robots that can interact with the physical world. Companies like Skild AI, which raised a massive $1.5 billion Series A, are developing a "shared brain" for robots, a physical AI foundation model that can be trained in simulation and fine-tuned in the real world [13]. This approach, where every deployment feeds back into a shared intelligence, promises to accelerate the learning curve for robots across industries. Similarly, Physical Intelligence is making waves with its morphology-agnostic approach, and is reportedly in talks to raise funding at a $5 billion valuation [14].

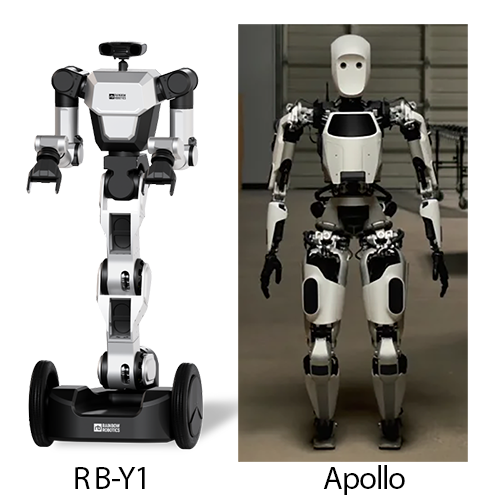

Figure 7: The fundamental debate between humanoid and wheeled robots centers on efficiency and practicality

The humanoid versus morphology-agnostic debate is a central theme in this new era of robotics. While companies like Tesla, Figure, and Agility are pouring billions into developing humanoid robots, a compelling counterargument is emerging. As Deena Shakir of Lux Capital points out, the "humanoid fallacy"—the assumption that human-shaped machines are the most effective—is a flawed premise [15]. The data supports this, with bipedal robots being significantly less energy-efficient than their wheeled or quadrupedal counterparts [15].

Figure 8: Boston Dynamics' robot evolution from BigDog to Atlas shows the progression of robotics technology

The commercial success of Boston Dynamics' Spot and Stretch robots, with over 1,500 Spot units deployed, compared to the uncommercialized Atlas, further underscores this point [15]. China has also emerged as a dominant force in the robotics race, with a whole-of-nation push into embodied intelligence. The country's 14th Five-Year Robotics Industry Plan aims to establish global leadership by the end of 2025, backed by a staggering $137 billion investment in robotics, AI, and innovation over the next two decades [16, 17]. Chinese firms are projected to manufacture over 10,000 humanoid robots in 2025, accounting for more than half of the global output [18].

The Age of Consensus Capital: A New Venture Paradigm?

The venture capital landscape itself is undergoing a profound transformation, moving away from its contrarian roots towards a new model of "Consensus Capital." As a recent Fast Company article provocatively asks, "Is it still Venture Capital… or just Consensus Capital?" [19]. The piece highlights a significant shift in the behavior of mega-funds like Andreessen Horowitz, which have become registered investment advisers, enabling them to invest in a wide range of assets beyond traditional startups, from public equities to crypto tokens [19].

More importantly, their investment style has evolved. Instead of making contrarian bets against the grain, these funds are increasingly writing massive checks into the same popular founders and rounds, creating a feedback loop that reinforces consensus rather than challenging it [19]. This shift has significant implications for the deep tech ecosystem, where breakthrough innovations often emerge from non-consensus ideas that are initially perceived as too risky or unconventional.

The debate around consensus versus non-consensus investing is not new, but it has taken on a new urgency in the current climate. While many investors claim to be contrarian, the real challenge lies in being "contrarian AND right" [20]. The rise of consensus capital suggests that the appetite for true contrarianism may be waning, particularly in the early stages where follow-on funding is crucial [21]. As one observer notes, "Today, being non-consensus means cutting through the noise, tuning out VC group-chat gossip, and backing the startups that still feel too weird or risky, even in a world where everyone claims to be a contrarian" [22].

This trend is particularly relevant for deep tech hardware startups, which often require significant capital and longer development cycles. The First Momentum Deep Tech Hardware Napkin report reveals that even at the pre-seed and seed stages, startups are raising large rounds with low tech readiness, indicating a strong investor appetite for tech risk [23]. However, the report also shows that revenue is not the main KPI even at Series A, highlighting the need for patient capital that is willing to bet on long-term technological breakthroughs rather than short-term revenue growth [23].

Silicon Valley's Hard Tech Awakening: From "Rest and Vest" to Real Innovation

The cultural transformation of Silicon Valley itself reflects the broader shift towards physical innovation. As The New York Times recently documented, the tech capital has entered its "hard tech" era, leaving behind the consumer-focused "Web 2.0" days of photo-sharing apps and streaming services [24]. The HBO series "Silicon Valley" once satirized the "rest and vest" culture of engineers collecting stock grants while doing little meaningful work, but that era is rapidly becoming ancient history [24].

Today's Silicon Valley conversations have shifted dramatically. Instead of discussions about HTML5 coding languages, the focus is on neural networks, large language models, and the coveted H100 graphics cards that power AI systems [24]. The change is palpable in office environments too—gone are the rainbow-colored beanbags and craft beer kegs, replaced by a more serious, mission-driven atmosphere focused on solving hard technical problems [24].

This cultural shift reflects a deeper understanding that the next wave of innovation will come from mastering the physical world, not just the digital one. As one industry observer notes, "Stacked up against ChatGPT's ability to instantly transform any image into a Studio Ghibli cartoon, Instagram's photo filters are practically Paleolithic" [24]. The bar for innovation has been raised, and the solutions increasingly require deep technical expertise and significant capital investment.

The China Challenge: A Strategic Reckoning

Eric Schmidt's recent observations about China's technological progress serve as a sobering wake-up call for the Western tech establishment. After traveling to China and witnessing their electric cars, drone food delivery systems, and humanoid robots firsthand, Schmidt concluded that "it is clear they are at parity or pulling ahead in many technologies" [25]. This isn't hyperbole—it's a strategic assessment from someone who has been at the forefront of American tech leadership.

Schmidt's analysis highlights a pattern that has repeated across multiple technology cycles: "Time and again, China has shown an edge in manufacturing, commercializing, and scaling innovations. From semiconductors in the 1990s to smartphones and electric vehicles, Silicon Valley underestimated how quickly China could produce low-cost, state-of-the-art alternatives" [25]. Now, they are applying this same playbook to AI and robotics with remarkable success.

The implications extend far beyond commercial competition. As Schmidt warns, "AI will touch every aspect of life including business, warfare, science, education, and healthcare. Countries that lead in AI development and integration will dominate the global economy and national security" [25]. His call to action is clear: "The U.S. must act decisively: develop policies to manage AI's impact, integrate AI into defense and operations, and ensure citizens embrace it as a tool in daily life" [25].

The CB Insights report on China's "Embodied Intelligence" strategy provides concrete evidence of this whole-of-nation approach [26]. The document reveals how China is systematically building capabilities across the robotics value chain, from fundamental research to commercial deployment. This isn't just about individual companies competing—it's about coordinated national strategy meeting market forces, a combination that has proven formidable in previous technology races.

The European Deep Tech Renaissance

While much attention focuses on the US-China competition, Europe is quietly building its own deep tech powerhouse. The First Momentum Deep Tech Hardware Napkin reveals that European deep tech startups raised €15 billion in 2024, with €648 million flowing to robotics companies alone in 2025 [23]. This represents a significant increase in both funding volume and investor appetite for technical risk.

What's particularly interesting about the European approach is the willingness to fund companies at lower levels of technical maturity. The report shows that even at pre-seed and seed stages, startups are raising substantial rounds despite being "often not past the lab stage" [23]. This suggests a more patient capital approach that could be crucial for breakthrough technologies that require longer development cycles.

The funding landscape shows some fascinating patterns. While pre-seed rounds have slightly decreased from €3 million to €2 million median, seed rounds have grown from €4 million to €5 million, with valuations jumping from €14 million to €19 million [23]. Perhaps most remarkably, Series B rounds now have a median size of over €50 million, indicating that European investors are willing to make substantial bets on scaling deep tech companies [23].

The sector distribution reveals strategic priorities: Next-Generation Computing leads with €447.1 million invested at an average round size of €37 million, followed by renewable energy technologies at €220.7 million [27]. This focus on computing infrastructure and clean energy aligns perfectly with the broader themes of AI infrastructure and energy transition that are reshaping the global tech landscape.

Additional Sources and Context:

• NVIDIA's Jensen Huang emphasizes the shift from traditional computer science to "generative physical AI," highlighting the convergence of AI with robotics and autonomous systems [28]

• Apple's AI strategy includes plans for robots, lifelike Siri, and home security cameras, showing how even consumer tech giants are pivoting to physical AI [29]

• Fourth Offset AI research on creating matter from energy represents the cutting edge of physics-based AI applications [30]

• Agility Robotics deployment of humanoid robots from warehouses to homes demonstrates the commercial viability of embodied AI [31]

• Bilal Zuberi's observations on the cost of intelligence approaching zero while physical capabilities become the new differentiator [32]

• Paulina Szyzdek's analysis of "robocorns" (billion-dollar robotics companies) and their path to commercial success [33]

• Ivan Poupyrev's insights on how AI is transforming hardware development and manufacturing processes [34]

The convergence of these trends—energy constraints, physical AI breakthroughs, geopolitical competition, and new funding models—is creating a perfect storm of innovation and disruption. We are witnessing the emergence of a new industrial age where the winners will be those who can successfully bridge the digital and physical worlds, creating intelligence that doesn't just think, but acts.

References

[1] McLain, C. (2025). AI's biggest bottleneck isn't algorithms — it's power. LinkedIn. https://www.linkedin.com/in/cameronmclain/

[2] Goldman Sachs. (2025, August 29). How AI is Transforming Data Centers and Ramping Up Power Demand. https://www.goldmansachs.com/insights/articles/how-ai-is-transforming-data-centers-and-ramping-up-power-demand

[3] Flow. (2025, September 8). How AI is reshaping the energy transition. https://flow.db.com/more/esg/how-ai-is-reshaping-the-energy-transition

[4] Visual Capitalist. (2025, September 12). Data Center Power Demand: 2023–2030. https://www.visualcapitalist.com/sp/gx03-charted-the-rising-share-of-u-s-data-center-power-demand/

[5] U.S. Department of Energy. (2025, September 8). Energy Department Seeks Proposals for AI Data Centers at Energy Projects at Idaho National Laboratory. https://www.energy.gov/ne/articles/energy-department-seeks-proposals-ai-data-centers-energy-projects-idaho-national

[6] Fox Business. (2025, August 19). Google strikes major nuclear power deal to fuel AI data centers with 50-megawatt capacity. https://www.foxbusiness.com/technology/google-strikes-major-nuclear-power-deal-fuel-ai-data-centers-50-megawatt-capacity

[7] World Economic Forum. (2025, August 27). 5 ways to unlock electricity for AI without building more power plants. https://www.weforum.org/stories/2025/08/5-ways-electricity-power-demand-ai/

[8] Georgia Tech News Center. (2025, September 3). AI's Ballooning Energy Consumption Puts Spotlight On Data Center Efficiency. https://news.gatech.edu/news/2025/09/03/ais-ballooning-energy-consumption-puts-spotlight-data-center-efficiency

[9] Fan, J. (2025). The past year has been a transformational experience to me. LinkedIn. https://www.linkedin.com/feed/update/urn:li:activity:7350535801027391488/

[10] TechCrunch. (2025, September 12). We are entering a golden age of robotics startups. https://techcrunch.com/2025/09/12/we-are-entering-a-golden-age-of-robotics-startups-and-not-just-because-of-ai/

[11] The Robot Report. (2025, August 26). Robotics investments top $4.3B in July 2025. https://www.therobotreport.com/robotics-investments-top-43b-in-july-2025/

[12] Sifted. (2025, August 20). The biggest robotics raises so far in 2025. https://sifted.eu/articles/the-biggest-robotics-raises-so-far-in-2025

[13] Simon's Flags. (2025). Skild AI unveils general-purpose AI model for multi-purpose robots. Provided content.

[14] The Information. (2025, September 10). Robotics Startup Physical Intelligence in Talks to Raise at $5 Billion Valuation. https://www.theinformation.com/articles/robotics-startup-physical-intelligence-talks-raise-5-billion-valuation

[15] Shakir, D. (2025, July 15). The Age of Embodied Intelligence: Why The Future of Robotics Is Morphology-Agnostic. Lux Capital. https://www.luxcapital.com/news/the-age-of-embodied-intelligence-why-the-future-of-robotics-is-morphology-agnostic

[16] The Washington Times. (2025, August 21). China crushes U.S. in robot race, putting 7x more droids to work. https://www.washingtontimes.com/news/2025/aug/21/china-increasing-robotics-development-market-dominance-using-whole/

[17] RoboBusiness. (2025, September 4). Keynote panel to explore how to close the robotics gap with China. https://www.robobusiness.com/keynote-panel-to-explore-how-to-close-the-robotics-gap-with-china/

[18] The Robot Report. (2025, September 10). China experiences physical AI surge - and how the U.S. should respond. https://www.therobotreport.com/china-experiences-physical-ai-surge-how-u-s-should-respond/

[19] Fast Company. (2025, September 5). Andreessen Horowitz is not a venture capital fund. https://www.fastcompany.com/91398458/andreessen-horowitz-vc-consensus-capital

[20] Hudson, C. (2025). Consensus vs Non-Consensus Investing, AI in Restaurants. LinkedIn. https://www.linkedin.com/posts/chudson_new-episode-of-the-learning-corner-by-precursor-activity-7369616274881961985-2c-1

[21] Newcomer. (2025, August 29). Martin Casado Isn't Backing Down. You Can't Ignore the Data. https://www.newcomer.co/p/martin-casado-isnt-backing-down-you

[22] New Internet. (2025, August 26). Non-Consensus is Dead. Long Live Non-Consensus. https://www.newinternet.tech/p/non-consensus-is-dead-long-live-non

[23] First Momentum. (2025, July). The Deep Tech Hardware Napkin 2025. https://www.firstmomentum.vc/

[24] Isaac, M. (2025, August 4). Silicon Valley Is in Its 'Hard Tech' Era. The New York Times. https://www.nytimes.com/2025/08/04/technology/ai-silicon-valley-hard-tech.html

[25] Schmidt, E. (2025). China's technological progress observations. LinkedIn. Referenced from provided content.

[26] CB Insights. (2025, August 10). Embodied Intelligence: The PRC's Whole-of-Nation Push into Robotics. China Brief Volume 25, Issue 15.

[27] IO+. (2025, September 3). €1.2B raised by European deep tech scaleups. https://ioplus.nl/en/posts/12b-raised-by-european-deep-tech-scaleups-including-axelera-ai-

[28] CNBC. (2025, July 18). NVIDIA CEO Jensen Huang on generative physical AI. https://www.cnbc.com/2025/07/18/nvidia-ceo-jensen-huang-study-field-computer-science-software-gpu-alexnet-generative-physical-ai-university.html

[29] Bloomberg. (2025, August 13). Apple's AI turnaround plan: robots, lifelike Siri and home security cameras. https://www.bloomberg.com/news/articles/2025-08-13/apple-s-ai-turnaround-plan-robots-lifelike-siri-and-home-security-cameras

[30] Fourth Offset AI. (2025). Creating matter from energy research. https://fourthoffset.ai/

[31] Agility Robotics. (2025). Humanoid robots from warehouse to your house. https://www.agilityrobotics.com/content/humanoid-robots-from-warehouse-to-your-house

[32] Zuberi, B. (2025). Cost of intelligence is going to zero. LinkedIn. https://www.linkedin.com/posts/bzuberi_cost-of-intelligence-is-going-to-zero-activity-7358231328409968640-jQFi

[33] Szyzdek, P. (2025). The Robocorns: How billion-dollar robotics companies are built. https://paulinaszyzdek.substack.com/p/the-robocorns-how-billion-dollar

[34] Poupyrev, I. (2025). AI transforming hardware development. LinkedIn. https://www.linkedin.com/posts/ivan-poupyrev_the-latest-the-new-york-times-piece-on-how-activity-7358900847654653952-1rVB

Written by Bogdan Cristei and Manus AI