Space to Watch: Micro Fulfillment Centers (MFCs)

Written by Bogdan Cristei of Shack15 Ventures and Tim Yang of Tyche Partners

Written by Bogdan Cristei of Shack15 Ventures and Tim Yang of Tyche Partners

Logistics automation is expected to be a large robotics adoption area over the next two to five years. Per Gartner, supply-chain-dependent companies will hire a new type of executive: the “Chief Robotics Officer”. [1] More and more decisions will happen at the edge, which is a significant driver of technology investment in the sector, and companies are starting to embed advanced analytics through smart edge ecosystems. [2]

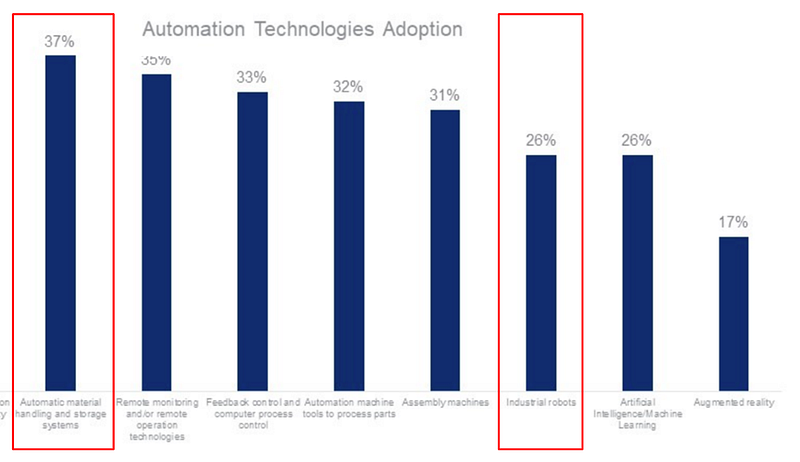

The pandemic is continuing to drive up demand for automated systems; over the last 12 months, spending on automation increased by 40% in aggregate. [3] However, automated supply chain and logistics — in particular storage and robotics, remain under-penetrated at 37% and 26% adoption respectively. This low penetration rate confirms the sector has a lot of room for growth. [4]

Micro Fulfillment Centers (MFC) are small, sometimes automated fulfillment centers that most often serve e-commerce and local store pick-ups. It is important to remember that “distribution” is different from “fulfillment”. Distribution sits higher on the supply chain, at the pallet or unit level; distribution positions products to be fulfilled. [5] Fulfillment refers to moving individual items to the end users, whether that’s at the store shelf, curbside pick-up, or home delivery. See example of an MFC below.

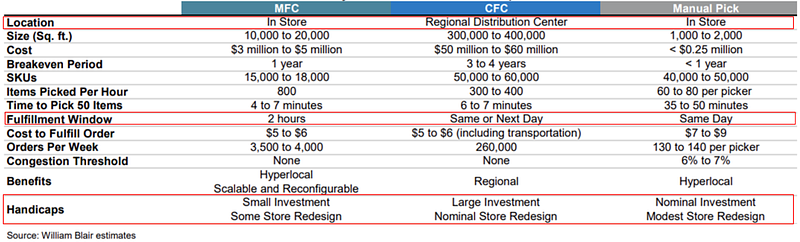

The table below shows the main differences between Micro Fulfillment Centers and Central Fulfillment Centers (courtesy of William Blair). An MFC can be thought of as a fulfillment space that is usually placed inside an existing store, at a relatively central location, and is about 5% the size of a traditional fulfillment center. The main purpose of an MFC is to materially reduce the fulfillment window to two hours versus more than twelve hours for traditional fulfillment centers. MFCs require vertical storage to maximize space utilization.

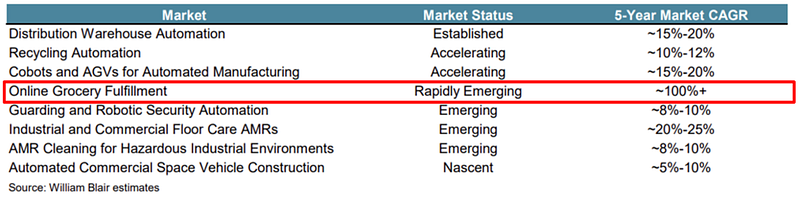

Last year roughly half of VC dollars invested in the robotics sector went to warehouse and logistics automation companies. Within warehouse and logistics, online grocery fulfillment is the fastest growing end market at 100% CAGR.

Also see: “DoorDash Introduces Ultra-Fast Grocery Delivery, Providing Busy Consumers with a Reliable and Convenient Way to Restock Instantly” [6] and Digital-First Grocery: Micro-Fulfillment vs. Central Fulfillment [7]

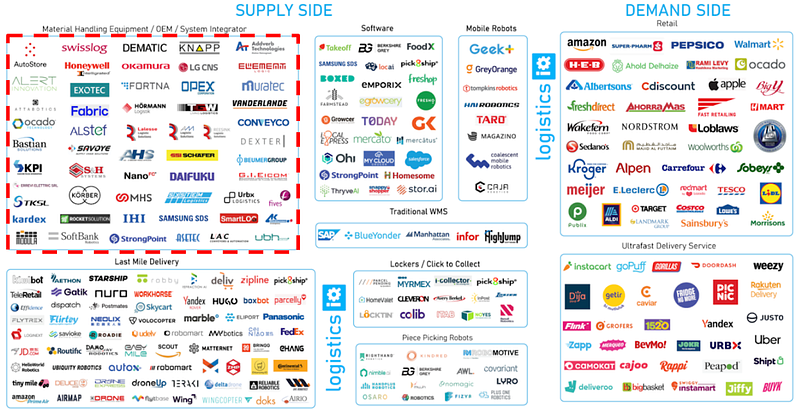

The MFC value chain and landscape is included below. Players include automation system providers, delivery vendors, software vendors, and so on. For this article we focus on automation system providers in the upper left corner of the map.

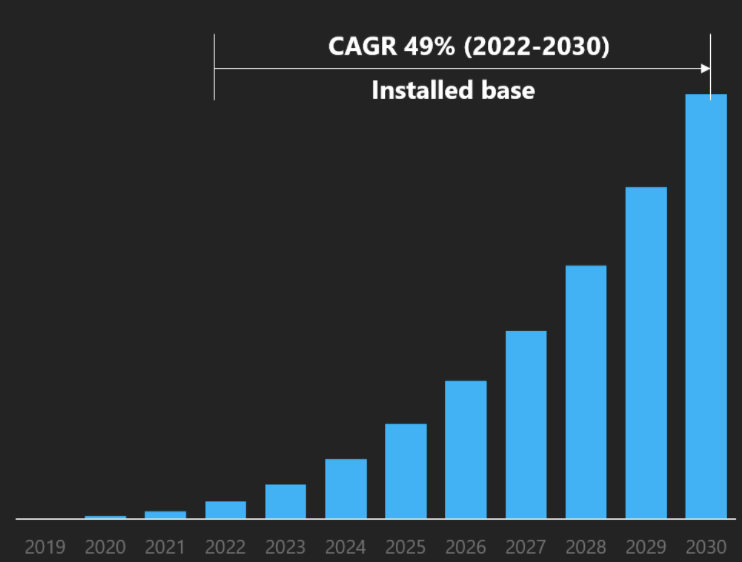

LogisticIQ expects MFC installations to grow from 50 in 2020 to ~6000 in 2030 globally [8]. Each deployed MFC costs roughly $5MM. Calculating (MFC install base of 6000) x ($5MM cost per unit) yields a sector market size of ~$30B. To put this 6000 MFCs number in context, the total square footage would be equivalent to ~300 traditional fulfillment centers. Today, Walmart and Amazon combined have ~300 fulfillment centers in the U.S. With 6000 MFCs globally, the penetration rate is still low with room to grow.

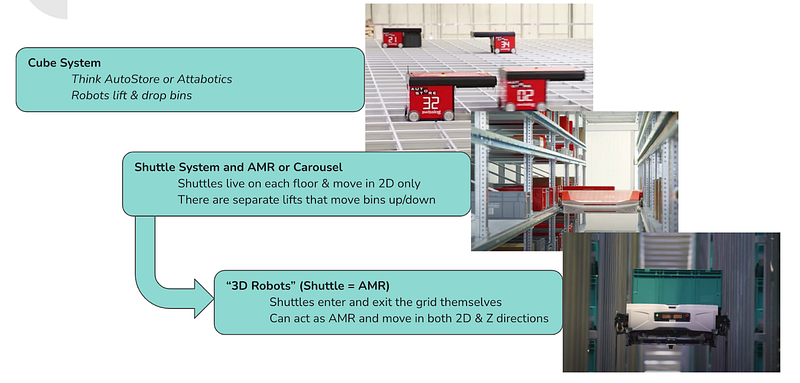

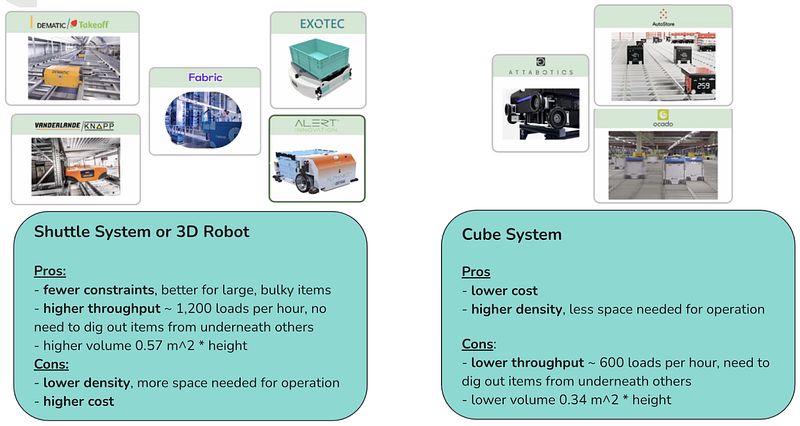

Existing solutions can be categorized in two buckets: “cube” systems and “shuttle” systems. Within cube systems, robots move on top of racks and fetch goods by lifting bins from the racks below them. Within shuttle systems, shuttles move back and forth on racks to send and retrieve goods. There is an interesting sub-category of shuttle systems: an autonomous mobile robot (AMR) that can both move on the ground, and climb the racks to retrieve goods; this sub-category is gaining traction in the MFC space. The images and videos below will clarify the existing technologies.

Shuttle systems are more flexible and have higher throughput, but they are more expensive and take up more space. On the other hand, cube systems are more compact and cheaper, but they have lower throughput — if the goods are in the bottom bins, the bots have to remove the bins on top to access the ones at the bottom. The “3D Robot” system is gaining traction in the MFC space as it is faster than the cube system, and more compact than the shuttle system. The 3D Robot system eliminates the need for conveyors and lifts, and is more modular thus easier to scale up and down; the bots are the only moving part in the system.

More details for key MFC automation players are provided in the table below. The top three are cube systems, and the bottom four are shuttle systems. Autostore went public last October and currently has a market cap of $9B; the stock is trading at ~20x forward EV/sales.

Example: Exotec

Exotec is a French industrial robotics startup, the company’s AMR is called “Skypod”. Skypod can attach itself onto a rack of shelves and ‘climb’ them in the Z direction, becoming “shuttles” as well. Exotec’s revenue was $120m in 2021, $60m in 2020, and $20m in 2019. Clients include Decathlon, Gap and Carrefour. Exotec raised $355 million in its Series D funding round, bringing it’s valuation to $2 billion. The company is working to “improve supply chain resilience,” CEO Romain Moulin said. Full Story: VentureBeat [9]

Example: Alert Innovation

Alert Innovation is working on Walmart’s MFC deployment efforts. The company’s key product is called “Alphabot’’ which is an AMR that can move on the ground floor, as well as freely within the grid in all three dimensions to send and receive goods. Alert’s key advantage over competitors is that their bots use supercapacitors instead of lithium batteries which enables the bot to work in a frozen environment. The capacitors are charged via contact with the grid. The main difference between Exotec and Alert is that Exotec’s AMR can only move up and down while Alert’s AMR can move up and down, as well as back and forth on the grid.

There are many other entrants into this category and our teams will continue to monitor progress and seek introductions to promising teams & technologies.

We conclude this post with key high-level questions to consider when diligencing robotics companies in the MFC space:

Technology scalability:

- Who is your ideal customer (sweet spot)?

- Is your product developed as a solution for 1–2 specific purposes or a platform that is upgradable?

- To upgrade/add functions to the robot, do you have to change the architecture of the product?

- Are your components largely off the shelf, or do you need to build specific components?

- How do you and your customer leverage the data generated by the robots to improve future performance?

- How long does it take to deploy your robotic solutions?

Operational pain points:

- What’s the customer ROI (payback period)? What are the key metrics that affect the ROI? (i.e. sq footage, throughput, number of machine deployed, etc)

- What’s the benefit of customers using your technology to solve their problems and how do they measure it?

- What’s the alternative solution for the use case? (does it have to be robotics?)

- Can your robot finish one task from beginning to end, or is it part of a larger process?

- What would be the cost to customers if there is a failure in your product?

End market:

- How do you quantify your addressable market and why?

- Key elements that prevented automation in the past few years?

- Are you replacing humans with your product or improving human productivity?

- Do customers need to retrofit existing facilities to use your robot?

- Are you charging customers on projects/services, units, or RaaS?

In summary, the MFC market is roughly a $30B opportunity, and existing solutions can be categorized in two buckets — “Cube” systems and “Shuttle” systems, each with pros and cons, but no categorical winner so far. Warehouse operations, in particular the “storage and robotics” space, remains underpenetrated at around %30 adoption, and this low penetration rate confirms the sector has a lot of room for growth.

What are your thoughts? To keep the conversation going, feel free to reach out to us at bogdan@unionlabs.com and tyang@tychepartners.com

References:

[1] Gartner: Chief Robotics Officer: A Top Automation Trend for 2022 (Published 23 November 2021 — ID G00743350)

[2] Gartner: Innovation Insight for Autonomous Mobile Robots (Published: 19 September 2019 ID: G00447898)

[3] Gartner: Hype Cycle for Drones and Mobile Robots, 2020 (Published: 6 July 2020 ID: G00441649)

[4] Citi Research Essentials

[5] Warehouse Anywhere: https://www.warehouseanywhere.com/resources/micro-fulfillment-centers-for-ecommerce/

[8] LogisticsIQ: https://www.thelogisticsiq.com

[9] VentureBeat: https://venturebeat.com/2022/01/16/industrial-robotics-company-exotec-raises-335m-to-improve-supply-chain-resilience/