The Founder's Complete Guide to Equity Splitting and Startup Incorporation in Silicon Valley

You have a brilliant idea, the passion to execute it, and the drive to build something that matters. Whether you're a seasoned tech professional, a recent graduate, or a career-changer ready to take the entrepreneurial leap, launching a startup in Silicon Valley requires navigating a complex landscape of legal, financial, and strategic decisions that can make or break your venture.

The most critical of these decisions revolve around two fundamental questions: How do you fairly split equity among your co-founders? And how do you structure your company to attract investors and scale successfully? These aren't just legal formalities—they're strategic choices that will impact every aspect of your business, from your ability to raise capital to your relationships with co-founders and employees.

This comprehensive guide is your roadmap through these crucial decisions. We've compiled the latest data from industry leaders like Carta and Stripe, analyzed current trends in Silicon Valley, and distilled expert advice into actionable insights. Whether you're a solo founder or leading a team, this article will equip you with the knowledge you need to confidently navigate conversations with lawyers, investors, and co-founders.

Consider this your startup incorporation playbook—a practical, data-driven manual that covers everything from the psychology of equity splits to the tax advantages of QSBS. Let's dive in.

The Evolution of Equity: How Silicon Valley Founders Are Splitting the Pie

The question of how to divide equity among co-founders has evolved significantly in recent years. Gone are the days when a single "visionary" founder would automatically claim the lion's share while technical co-founders received smaller stakes. Today's Silicon Valley startups are embracing more collaborative and equitable approaches to ownership.

The Data: Equal Splits Are on the Rise

The numbers tell a compelling story. According to Carta's 2024 analysis of thousands of startups, 45.9% of two-person founding teams now split their equity equally—a dramatic increase from just 31.5% in 2015. For three-person teams, the trend is even more pronounced, with equal splits rising from 12.1% to 26.9% over the same period [1].

This shift reflects a broader cultural change in Silicon Valley's startup ecosystem. Founders are increasingly recognizing that building a successful company requires diverse skills and perspectives, and that early equity decisions set the tone for the company's culture and values.

However, equal doesn't always mean fair. The key is understanding when an equal split makes sense and when other factors should influence your decision.

The 11 Factors That Should Drive Your Equity Decision

Before you default to an equal split, consider these critical factors that should influence your equity allocation. Based on extensive research from Stripe and other industry sources [2], here's what matters most:

1. Skills and Expertise

Every founder brings different capabilities to the table. A technical founder might be essential for building the product, while a business-focused co-founder could be crucial for customer acquisition and fundraising. The key is honestly assessing both current contributions and future value.

2. Time Commitment

Not all founders can commit equally from day one. Someone leaving a high-paying job to work full-time deserves different consideration than a co-founder who's still employed elsewhere and contributing evenings and weekends.

3. Financial Investment

If one founder is putting significant personal capital into the company—whether for initial development, equipment, or living expenses—this financial risk should be reflected in the equity structure.

4. Network and Credibility

In Silicon Valley, relationships matter enormously. A co-founder with deep industry connections, a track record of successful exits, or relationships with potential customers and investors brings tangible value that extends far beyond their day-to-day contributions.

5. Past and Future Roles

Consider both what each founder has already contributed (perhaps one developed the initial prototype or conducted market research) and what roles they'll play going forward. The founder who will be CEO and face investors has different responsibilities than the CTO focused on product development.

6. Risk Tolerance

Different founders have different appetites for risk, which affects their willingness to make bold decisions and their ability to weather the inevitable ups and downs of startup life. Higher risk tolerance can justify higher equity stakes.

7. Vesting Considerations

While vesting schedules don't directly impact initial equity splits, thinking about how equity will vest over time can inform your initial allocation decisions.

8. Exit Strategy Alignment

Make sure all founders are aligned on the company's long-term goals. Someone hoping for a quick acquisition may have different priorities than a co-founder planning to build a decades-long business.

9. Legal and Fiduciary Responsibilities

The CEO will have greater legal responsibilities and fiduciary duties than other founders. This additional liability and responsibility should factor into equity discussions.

10. Leadership and Team Dynamics

Some founders naturally emerge as leaders who can motivate teams, make difficult decisions, and represent the company externally. These "soft skills" are often undervalued but critically important.

11. Opportunity Cost

What is each founder giving up to join the startup? Someone leaving a $300K job at Google is making a different sacrifice than someone fresh out of college or between jobs.

Modern Approaches to Equity Splitting

Today's Silicon Valley founders have moved beyond simple equal splits to embrace more sophisticated approaches that better reflect each founder's contributions and circumstances.

Equal Splits: The Default Choice

Despite its limitations, equal splitting remains popular because it's simple, avoids difficult conversations, and can foster a collaborative culture. It works best when founders have similar backgrounds, commitment levels, and risk tolerance.

Weighted Contributions: The Analytical Approach

This method involves quantifying each founder's contributions across multiple dimensions—time, money, skills, network—and splitting equity proportionally. It's more complex but can result in a fairer allocation that all parties understand and accept.

Dynamic Equity: The Performance-Based Model

Some startups use dynamic equity models where ownership percentages adjust based on ongoing contributions or achievement of specific milestones. This approach can account for changing circumstances but requires careful legal structuring and can create ongoing tension.

Role-Based Allocation: The Hierarchical Model

In this approach, equity is allocated based on roles and responsibilities, with the CEO typically receiving the largest stake. This creates clear expectations but may not reflect actual value creation.

Hybrid Models: The Best of Both Worlds

Many successful startups combine multiple approaches—perhaps starting with weighted contributions but including performance-based adjustments or role-based considerations.

The key is choosing an approach that fits your team's dynamics and values while being transparent about the reasoning behind your decisions.

Incorporation Essentials: Building Your Legal Foundation

Once you've sorted out equity splits, the next critical step is incorporating your company. In Silicon Valley's venture capital ecosystem, there's really only one choice that makes sense: the Delaware C-Corporation.

Why Delaware C-Corp Is Non-Negotiable for VC-Backed Startups

If you're planning to raise venture capital—and most Silicon Valley startups are—incorporating as a Delaware C-Corporation isn't just recommended, it's practically required. Here's why:

Investor Expectations

Venture capitalists invest in hundreds of companies and have standardized processes. They expect Delaware C-Corps because the legal framework is well-understood, predictable, and investor-friendly.

Legal Precedent and Clarity

Delaware has over a century of corporate law precedent. When disputes arise or complex situations emerge, there's usually existing case law to provide guidance. This reduces legal uncertainty and costs.

Flexibility for Complex Capital Structures

As you raise multiple rounds of funding, you'll need to issue different classes of stock with varying rights and preferences. Delaware corporate law provides the flexibility to create these complex structures.

Stock Option Compatibility

Attracting top talent in Silicon Valley requires offering equity compensation. C-Corps make it straightforward to create employee stock option pools and grant options with favorable tax treatment.

QSBS Tax Advantages

Perhaps most importantly, Delaware C-Corps can qualify for Qualified Small Business Stock (QSBS) treatment, which we'll discuss in detail below.

The Incorporation Checklist: Essential Documents and Decisions

When incorporating your Delaware C-Corp, you'll need to make several key decisions and create essential legal documents:

Share Structure Decisions

- Authorized Shares: Typically 10-20 million shares to provide flexibility for future fundraising

- Issued Shares: Usually 6-8 million shares split among founders, leaving room for employee options

- Share Price: Often $0.0001 per share to minimize founder tax obligations

Essential Legal Documents

- Certificate of Incorporation: Filed with Delaware, establishes the company legally

- Bylaws: Internal rules governing company operations and board procedures

- Founder Stock Purchase Agreements: Document each founder's stock purchase and vesting terms

- 83(b) Elections: Critical tax elections that must be filed within 30 days (more on this below)

- IP Assignment Agreements: Ensure all founder-created intellectual property belongs to the company

- Equity Incentive Plan: Framework for granting employee stock options

- Board and Stockholder Consents: Initial governance decisions and officer appointments

The QSBS Goldmine: Tax Benefits Worth Millions

One of the most powerful but underutilized benefits of incorporating as a Delaware C-Corp is qualifying for Qualified Small Business Stock (QSBS) treatment under Section 1202 of the tax code.

The Benefits Are Staggering

QSBS allows founders and early employees to exclude up to 100% of their capital gains from federal taxes when they sell their stock. The exclusion is capped at the greater of $10 million or 10 times the taxpayer's basis in the stock.

Requirements for QSBS

- Must be a C-Corporation

- Company's gross assets must be $50 million or less when stock is issued

- Must hold the stock for at least 5 years

- Company must be engaged in an active business (not passive investments)

- Stock must be original issue stock purchased directly from the company

The Strategic Imperative

Starting the 5-year QSBS clock early is crucial. If you wait until after raising significant funding, you might miss the $50 million asset threshold. This is why many successful founders incorporate and issue founder stock as soon as they start working on their business seriously.

Real-World Impact

Consider a founder who owns 20% of a company that exits for $100 million. Without QSBS, they might pay $4-5 million in federal capital gains taxes on their $20 million gain. With QSBS, that tax bill could be zero.

Vesting: Protecting Your Company and Aligning Incentives

Even the most committed co-founders can have life changes, disagreements, or simply lose interest in the business. Vesting schedules protect your company by ensuring that equity is earned over time rather than granted immediately.

The Silicon Valley Standard: 4 Years with a 1-Year Cliff

The overwhelming majority of Silicon Valley startups use a standard vesting schedule that has become industry norm:

How It Works

- Total Period: 4 years (48 months)

- Cliff Period: 1 year (12 months) with no vesting

- Post-Cliff Vesting: Monthly vesting of remaining shares (1/36 per month)

The Logic Behind the Structure

The one-year cliff ensures that founders who leave early (often due to co-founder disputes or lack of commitment) don't walk away with significant equity. The monthly vesting after the cliff provides ongoing incentive to stay while allowing for some equity accumulation if someone needs to leave for legitimate reasons.

Acceleration Provisions

Many vesting agreements include acceleration provisions that speed up vesting in certain circumstances:

- Single-trigger acceleration: Vesting accelerates upon acquisition

- Double-trigger acceleration: Requires both acquisition and termination without cause

- Partial acceleration: Perhaps 12-24 months of acceleration rather than full acceleration

The 83(b) Election: A Critical Tax Decision

When you purchase founder stock subject to vesting, you face an important tax decision that must be made within 30 days of purchase.

The Problem Without 83(b)

If you don't file an 83(b) election, the IRS treats you as receiving stock as it vests. If your company becomes valuable, you could face enormous tax bills on "phantom income" as your shares vest.

Example: You buy 1 million shares at $0.0001 per share ($100 total). Two years later, when 50% of your shares vest, the company has raised funding and your shares are worth $1 each. Without an 83(b) election, you'd owe taxes on $500,000 of ordinary income—even though you haven't sold any stock.

The 83(b) Solution

By filing an 83(b) election within 30 days of purchasing your stock, you choose to pay taxes on the value of all your shares at the time of purchase. Since founder stock is typically purchased at or near fair market value (often fractions of a penny per share), this results in minimal or no immediate tax liability.

The Deadline Is Absolute

The 30-day deadline for filing 83(b) elections is absolute—there are no extensions or exceptions. Missing this deadline can cost founders hundreds of thousands or even millions of dollars in unnecessary taxes.

Building Your Team: Advisors and Employee Equity

As your startup grows, you'll need to attract advisors and employees with equity compensation. Understanding market rates and best practices will help you make competitive offers while preserving equity for future needs.

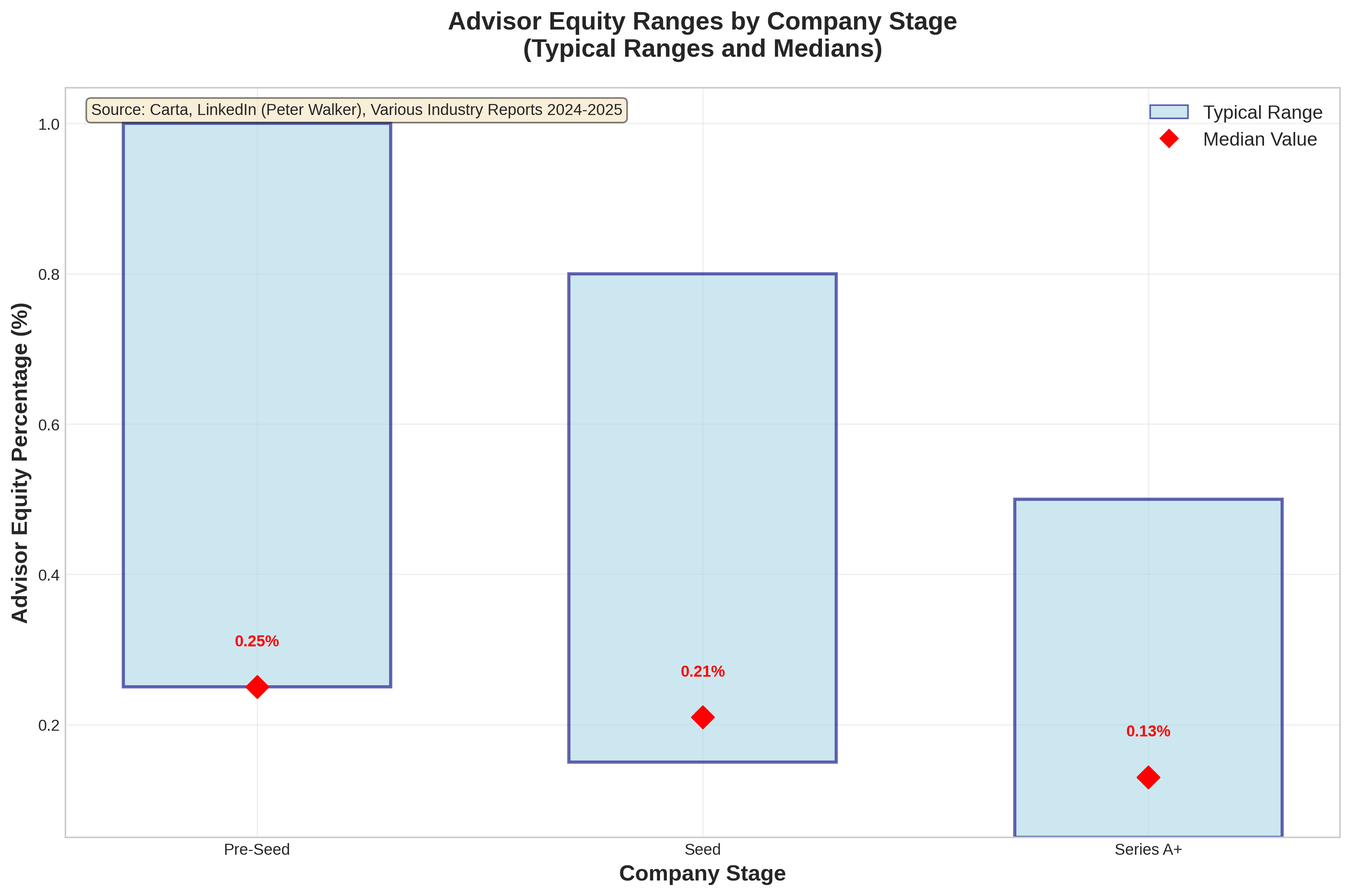

Advisor Equity: What the Data Shows

Advisors can provide valuable expertise, connections, and credibility, but compensating them appropriately requires understanding current market rates.

Current Market Data (2024)

According to recent analysis by Carta and industry experts:

- Median advisor equity: 0.25% for pre-seed companies

- Typical range: 0.01% to 1.00% depending on stage and involvement

- Only 10% of pre-seed advisors receive 1% or more equity

Factors Affecting Advisor Equity

- Company stage: Earlier stage companies typically grant higher percentages

- Advisor profile: Industry legends and successful serial entrepreneurs command premium rates

- Level of involvement: Active advisors who attend board meetings and make introductions deserve more than passive advisors

- Specific expertise: Advisors filling critical knowledge gaps may warrant higher compensation

Vesting for Advisors

Advisor equity should also vest over time, typically:

- Duration: 1-2 years (shorter than employee vesting)

- Cliff: Often no cliff or a shorter 3-6 month cliff

- Schedule: Monthly vesting after any cliff period

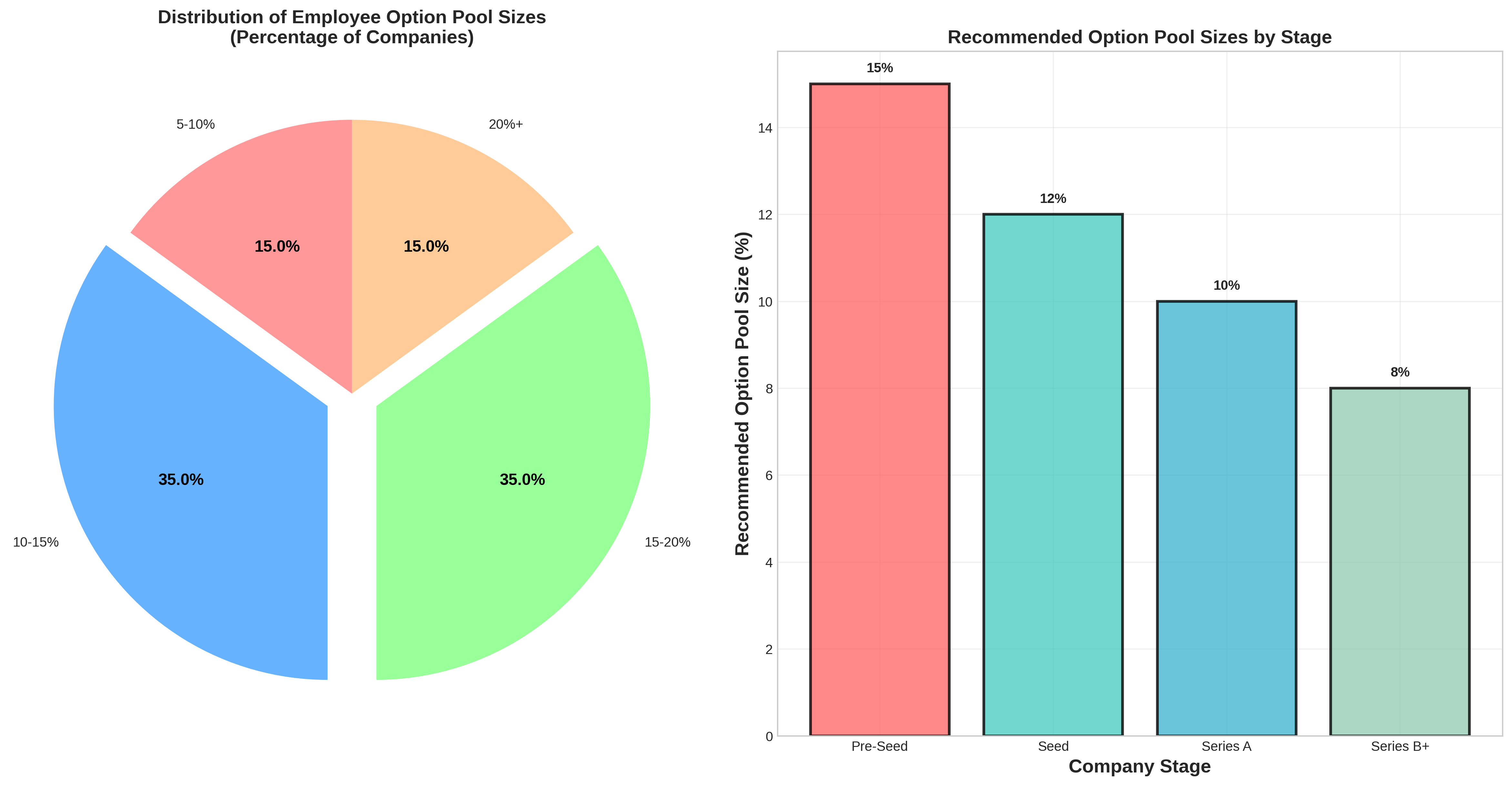

Employee Stock Options: Building Your Talent Pool

Attracting top talent in Silicon Valley's competitive market requires offering meaningful equity compensation through stock options.

Option Pool Sizing

- Typical range: 10-20% of total company equity

- Stage considerations: Earlier companies often need larger pools to attract senior talent

- Growth planning: Size your pool based on realistic hiring plans, not arbitrary percentages

Individual Grant Sizes

Option grants vary widely based on role, seniority, and company stage:

- Senior executives: 0.5-2.0% of company equity

- Senior engineers: 0.1-0.5% of company equity

- Mid-level employees: 0.05-0.25% of company equity

- Junior employees: 0.01-0.1% of company equity

Vesting Terms

Employee options typically follow the same 4-year vesting schedule as founder stock, with some variations:

- Standard: 4 years with 1-year cliff

- Senior hires: May negotiate for partial acceleration or shorter cliffs

- Performance-based: Some companies tie vesting to performance milestones

Common Pitfalls and How to Avoid Them

Even well-intentioned founders make mistakes that can have lasting consequences. Here are the most common pitfalls and how to avoid them:

Equity and Vesting Mistakes

Mistake 1: No Vesting for Founders

Some founders think vesting only applies to employees. This leaves the company vulnerable if a founder leaves early with a large equity stake.

Solution: All founders should have vesting schedules, even if they're modified (perhaps 25% immediate vesting with the remainder vesting over 3 years).

Mistake 2: Missing the 83(b) Deadline

This is perhaps the most expensive mistake founders make.

Solution: File 83(b) elections immediately after purchasing stock. Send via certified mail and keep proof of filing.

Mistake 3: Informal Equity Agreements

Handshake deals and informal agreements lead to disputes and legal problems.

Solution: Document all equity arrangements in proper legal agreements reviewed by qualified attorneys.

Incorporation Mistakes

Mistake 1: Wrong Entity Type

Incorporating as an LLC or S-Corp can create expensive conversion requirements later.

Solution: Start with a Delaware C-Corp if you plan to raise venture capital.

Mistake 2: Poor Cap Table Hygiene

Messy cap tables with too many small investors or unclear ownership can derail fundraising.

Solution: Use professional cap table management tools and keep detailed records from day one.

Mistake 3: Ignoring QSBS Requirements

Failing to structure for QSBS can cost millions in unnecessary taxes.

Solution: Incorporate early, issue stock at fair market value, and monitor the $50 million asset threshold.

Your Action Plan: Next Steps for Founders

Now that you understand the key principles, here's your step-by-step action plan:

Phase 1: Equity and Team Alignment

- Conduct founder equity discussions using the 11 factors framework

- Document your equity split in a founder agreement

- Align on roles, responsibilities, and expectations

- Discuss vesting schedules and acceleration provisions

Phase 2: Legal Foundation

- Choose incorporation service (Clerky, Stripe Atlas, or attorney)

- File Delaware C-Corp incorporation documents

- Create essential legal documents (bylaws, stock purchase agreements, etc.)

- File 83(b) elections within 30 days of stock purchase

- Set up cap table management system

Phase 3: Operational Setup

- Open business bank account

- Set up accounting and bookkeeping systems

- Create equity incentive plan for future employees

- Establish board governance procedures

Phase 4: Growth Preparation

- Monitor QSBS compliance as you grow

- Plan advisor and employee equity grants

- Maintain clean cap table records

- Prepare for fundraising with proper documentation

Conclusion: Building for Success

Starting a company in Silicon Valley is both an incredible opportunity and a complex challenge. The decisions you make about equity, incorporation, and team building in your company's early days will have lasting impacts on your ability to raise capital, attract talent, and ultimately achieve your vision.

The data is clear: successful founders are increasingly embracing more equitable and thoughtful approaches to equity distribution. They're incorporating as Delaware C-Corps to access venture capital and tax benefits. They're implementing proper vesting schedules and governance structures. And they're building diverse, committed teams aligned around shared success.

This guide has given you the knowledge and tools to make these critical decisions confidently. But remember that every startup is unique, and there's no substitute for professional legal and tax advice tailored to your specific situation.

The Silicon Valley ecosystem rewards founders who combine vision with execution, innovation with sound business practices. By following the principles and best practices outlined in this guide, you're positioning your startup for success in one of the world's most competitive and rewarding entrepreneurial environments.

Now go build something amazing.

By Bogdan Cristei & Manus AI | September 17, 2025

References

[1] Carta. (2025). Founder Ownership Report 2025. https://carta.com/data/founder-ownership/

[2] Stripe. (2023, November 29). How to split equity among startup cofounders. https://stripe.com/resources/more/how-to-split-equity-among-cofounders-in-a-startup

[3] Walker, P. J. (2024, October). If your pre-seed startup advisor asks for... [LinkedIn post]. https://www.linkedin.com/posts/peterjameswalker_if-your-pre-seed-startup-advisor-asks-for-activity-7246919777695227905-y_EF

[4] Kruze Consulting. (2024, October 24). How to Incorporate a Startup. https://kruzeconsulting.com/blog/how-incorporate-startup/

[5] Investopedia. (n.d.). Qualified Small Business Stock (QSBS): Definition and Tax Benefits. https://www.investopedia.com/terms/q/qsbs-qualified-small-business-stock.asp

[6] Carta. (2024, March 9). Stock Vesting: Options, Vesting Periods, Schedules & Cliffs. https://carta.com/learn/equity/stock-options/vesting/

[7] LTSE. (n.d.). Option pool sizing and allocation — by the numbers. https://ltse.com/insights/option-pool-sizing-by-the-numbers

[8] Founders Network. (n.d.). Advisor Startup Equity: What You Need to Know. https://foundersnetwork.com/advisor-startup-equity-what-you-need-to-know/

[9] Legal Nodes. (n.d.). Startup Incorporation in Delaware: A Guide for Founders. https://legalnodes.com/article/delaware-incorporation-founders-guide

[10] Capbase. (2022, March 30). Vesting Schedules: Best Practices for Startup Founders. https://capbase.com/founder-vesting-schedules-best-practices/

By Bogdan Cristei & Manus AI | September 17, 2025