Thin Films Series: The Hidden Coating Inside Every Battery

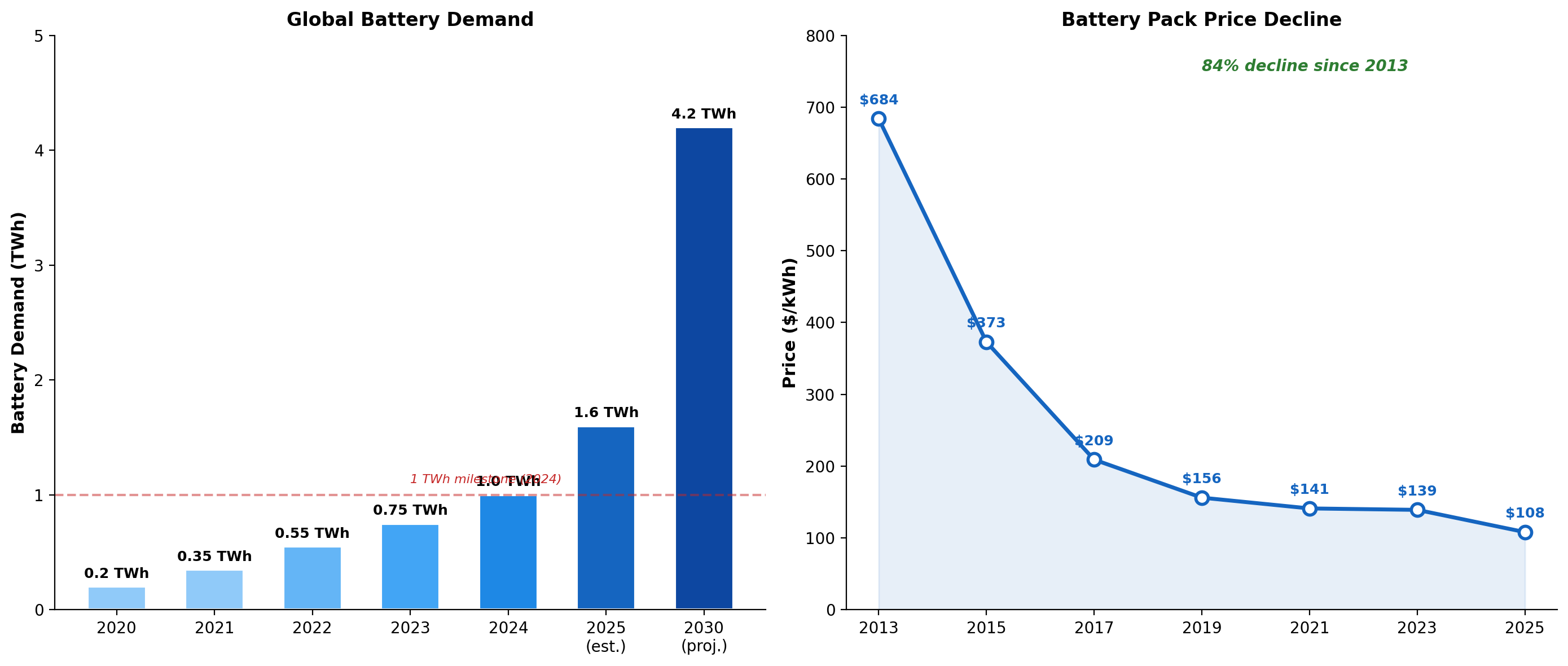

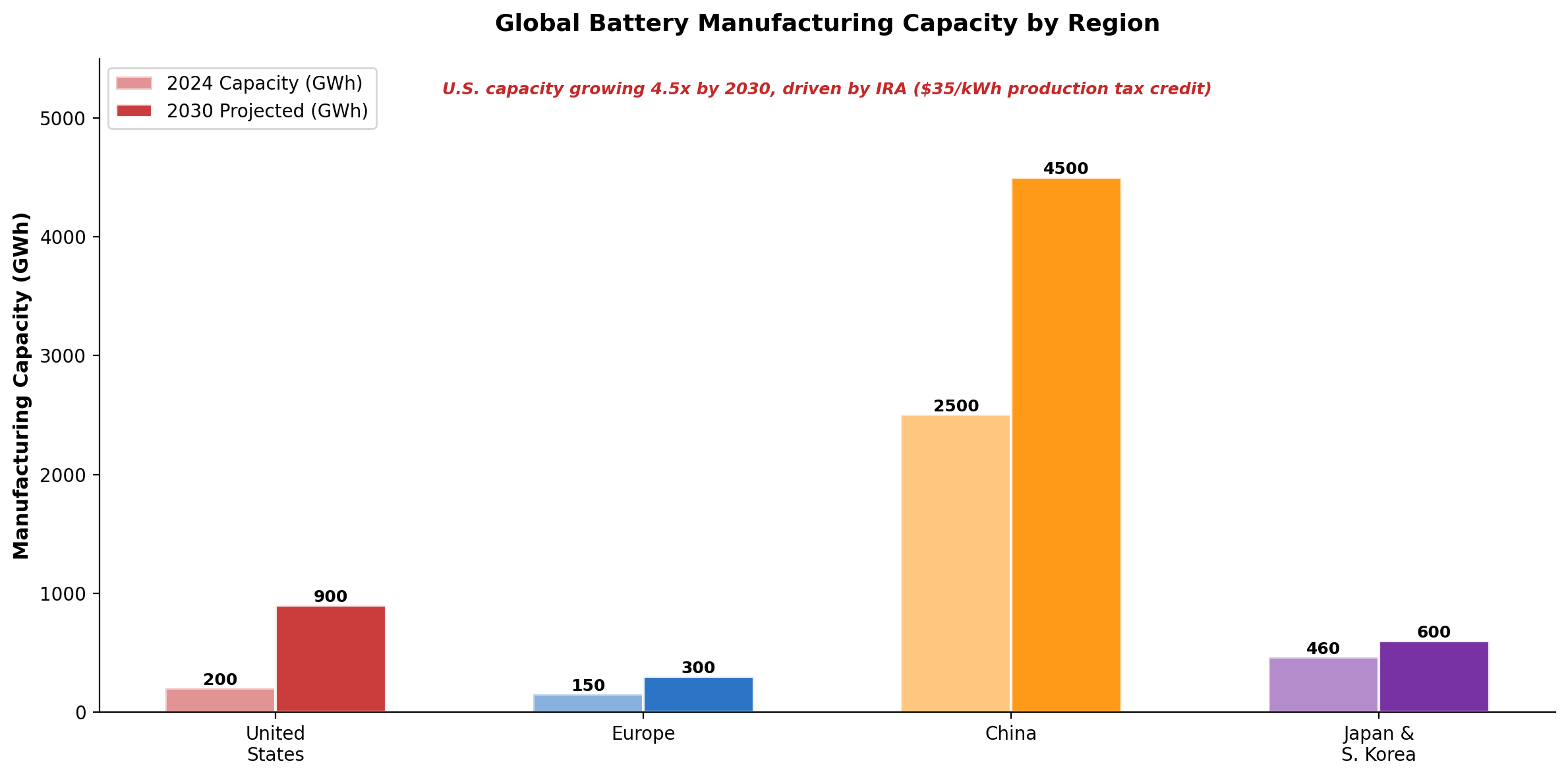

The electric vehicle revolution and the global transition to renewable energy are built on a single, foundational technology: the lithium-ion battery. This market is in a state of explosive, unprecedented growth. In 2024, annual battery demand surpassed 1 terawatt-hour (TWh) for the first time, a historic milestone. By 2030, that demand is projected to more than quadruple to over 4.2 TWh [1] [2]. This surge is fueling a global manufacturing boom, with hundreds of new "gigafactories" being built across the United States, Europe, and Asia.

However, behind the headlines of multi-billion-dollar investments lies a brutal manufacturing reality. The performance, safety, and cost of every battery cell comes down to the quality of its electrodes—the anode and cathode. And at their core, battery electrodes are thin films: a delicate, precisely-engineered coating of active material slurry applied to a metal foil, often no thicker than a human hair.

This article, the third in our series on thin film manufacturing, explores the high-stakes world of battery electrode production. We will uncover why mastering this thin film coating process is the single most critical challenge for Western manufacturers, how a massive "yield gap" with Chinese competitors is costing companies billions, and why the future of the energy transition depends on getting this one, critical layer absolutely perfect.

Source: IEA, McKinsey & Company, BloombergNEF [1] [2] [3]

Every Battery is a Thin Film Sandwich

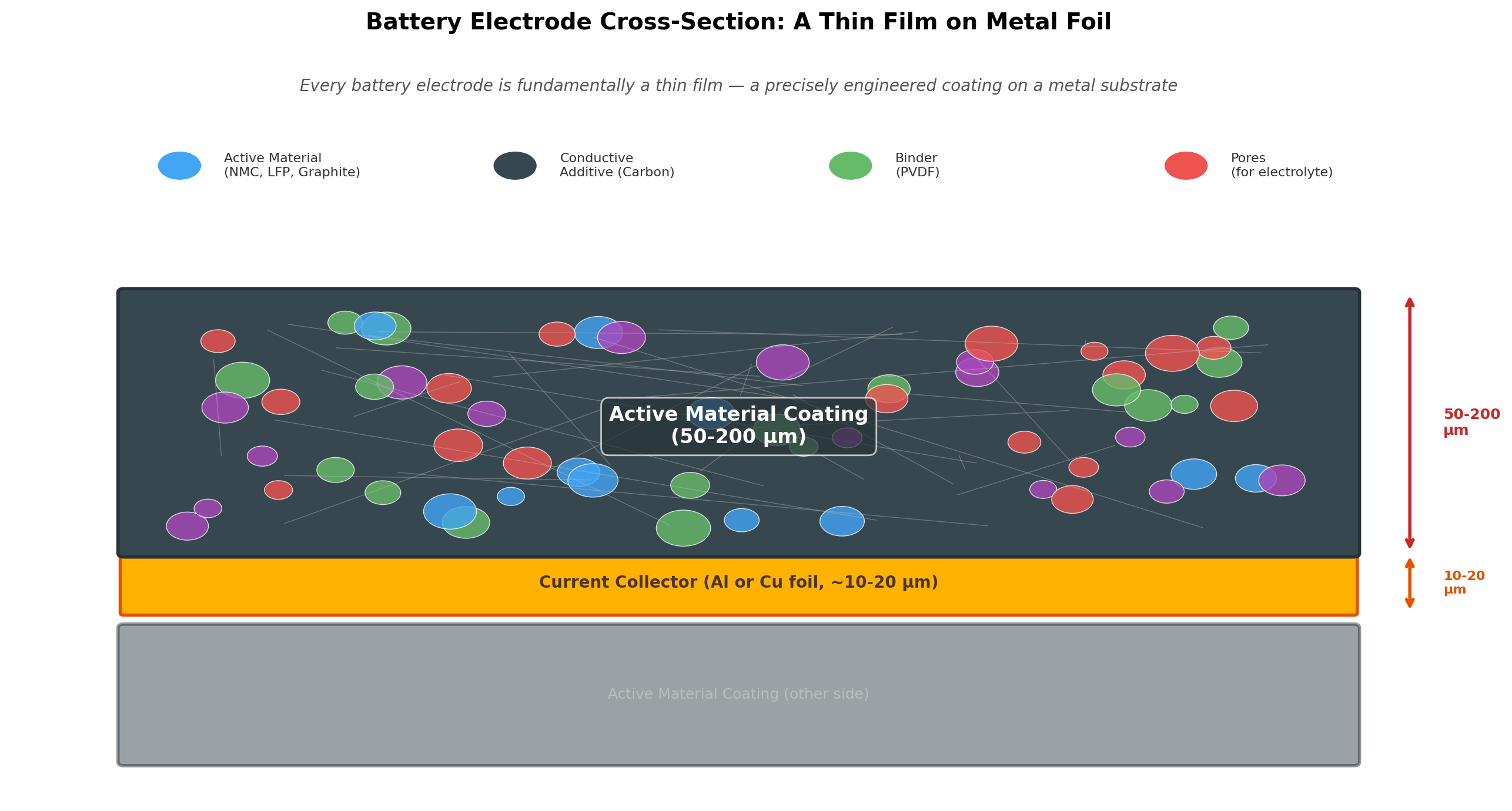

To understand the manufacturing challenge, one must first understand the structure of an electrode. It is not a solid piece of metal, but a composite structure created through a multi-stage thin film process. A slurry, containing active materials (like NMC or LFP for cathodes, graphite for anodes), a binder to hold it together, and conductive additives, is coated onto a thin metal foil—aluminum for the cathode, copper for the anode. This coated foil is then dried, compressed, and cut to size.

A battery electrode is a composite thin film, where active materials, binders, and additives are coated onto a metal foil substrate. The quality of this layer determines everything.

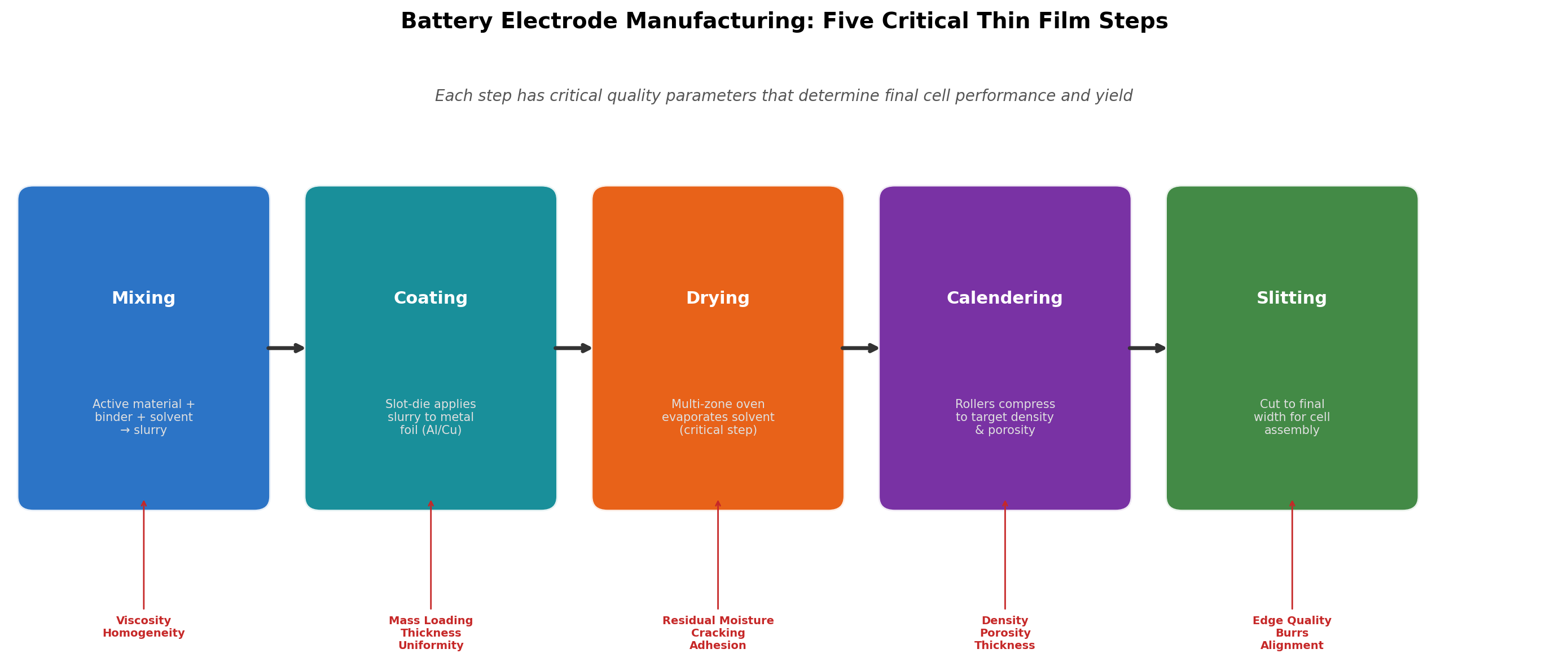

The entire process is a sequence of critical thin film operations, each with its own set of parameters that must be controlled with extreme precision.

The five core steps of electrode manufacturing. A failure at any stage can lead to a defective cell and costly scrap.

Key quality parameters that must be monitored and controlled at all times include:

- Mass Loading: The amount of active material per unit area.

- Thickness & Uniformity: The consistency of the coating across the entire electrode.

- Porosity & Density: The spacing within the material, which affects electrolyte flow and energy density.

- Adhesion: How well the coating sticks to the metal foil.

- Residual Moisture: Any remaining solvent after drying, which can cause catastrophic cell failure.

If any of these parameters deviate, the resulting battery cell can suffer from reduced capacity, a shorter lifespan, or even dangerous safety issues like short circuits. In a high-volume gigafactory, even a minor process variation can lead to millions of dollars in scrapped material.

The Great Yield Gap: A Multi-Billion Dollar Problem

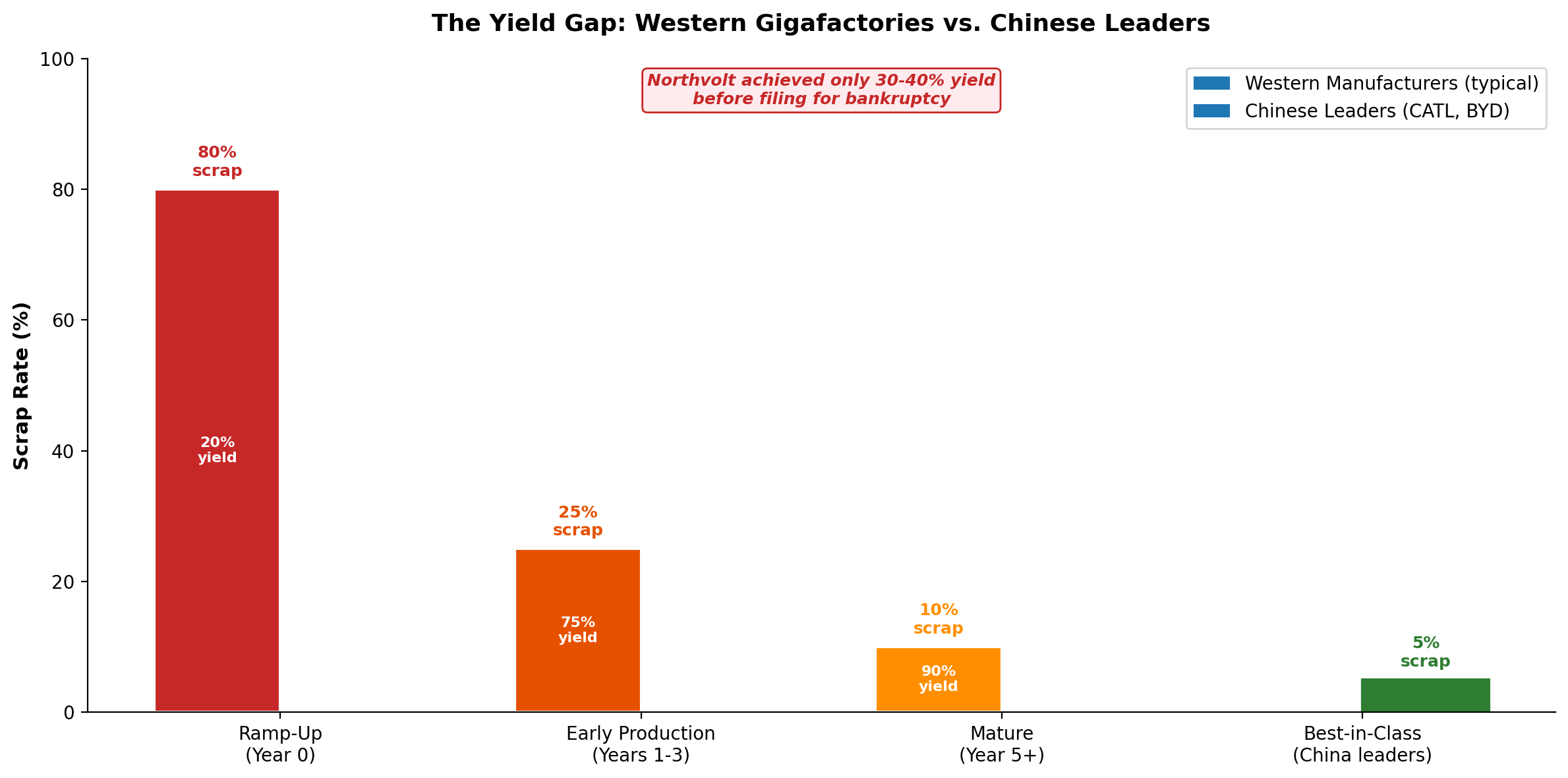

The primary battleground in the global battery race is not raw materials or factory size; it is manufacturing yield. Yield is the percentage of products that come off the production line meeting all quality specifications. While established Chinese manufacturers like CATL and BYD have spent over a decade optimizing their processes to achieve mature yields of 90-95%, new Western gigafactories are facing a brutal reality.

It is common for new battery production lines to experience scrap rates of 70-90% during the initial ramp-up phase. Even after the first few years, many factories struggle with scrap rates of 15-30% [4].

Source: Fraunhofer Institute for Production Technology IPT [4]

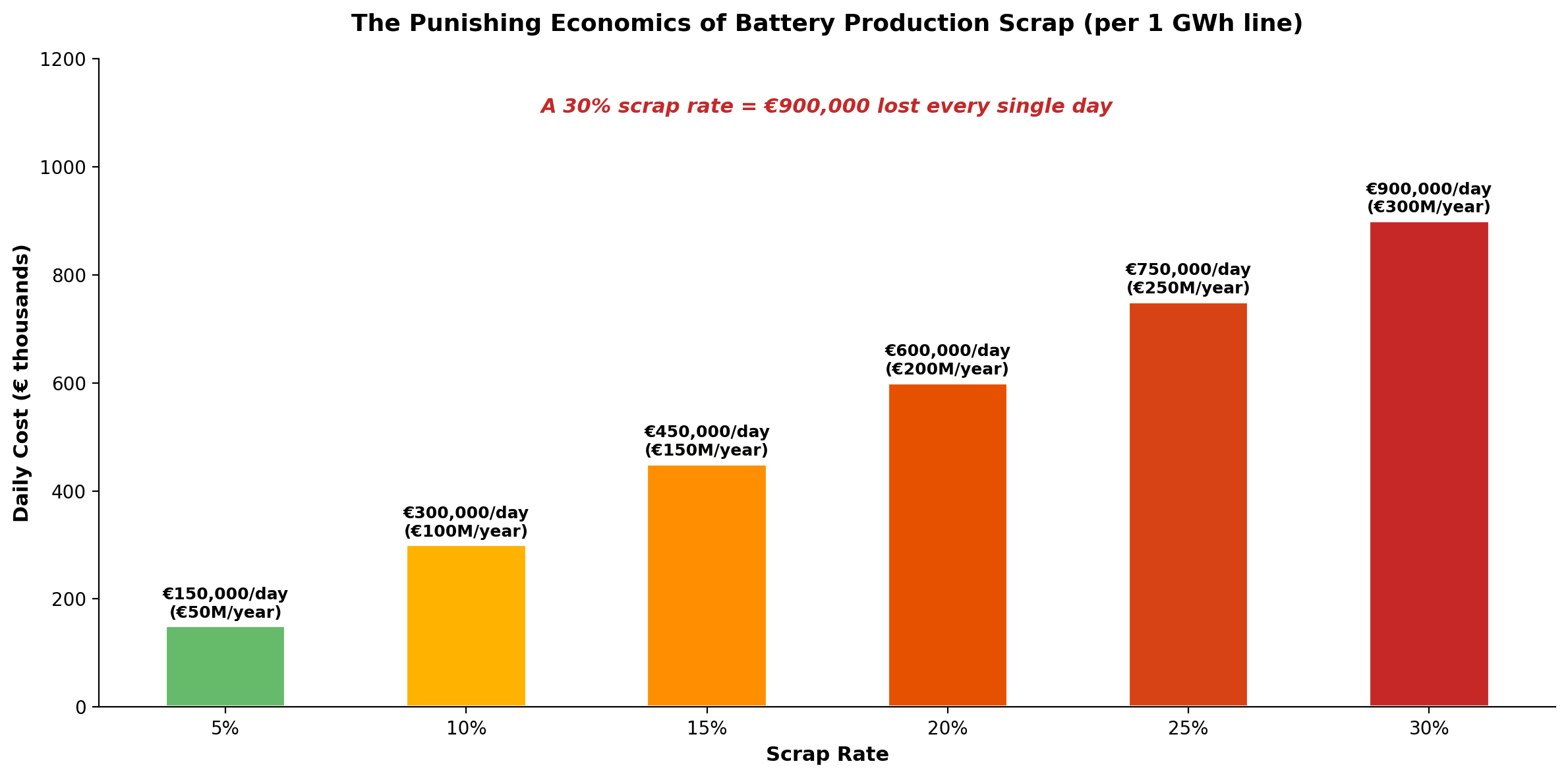

The financial consequences are staggering. Research from the Fraunhofer Institute estimates that for a typical 1 GWh production line, each percentage point of scrap costs approximately €10 million per year [4]. A factory struggling with a 30% scrap rate could be losing nearly €900,000 every single day.

Source: Fraunhofer Institute for Production Technology IPT [4]

A Cautionary Tale: The Collapse of Northvolt

The story of Northvolt, once hailed as Europe’s great battery hope, serves as a stark warning. Despite raising over $15 billion and securing backing from major automakers, the company filed for bankruptcy in late 2024. The primary cause of its failure was an inability to solve the production yield problem. Reports indicated that Northvolt’s production lines were struggling with a yield rate of just 30-40%, while its Asian competitors were consistently operating above 90% [5]. This immense gap meant the company could not produce high-quality cells at a competitive cost or scale, leading to a catastrophic contract cancellation from BMW and its eventual collapse.

Northvolt's failure is a powerful testament to the fact that capital alone cannot solve the fundamental challenge of manufacturing excellence. Without mastering the thin film coating process, even the most well-funded ventures can fail.

A Tale of Two Chemistries

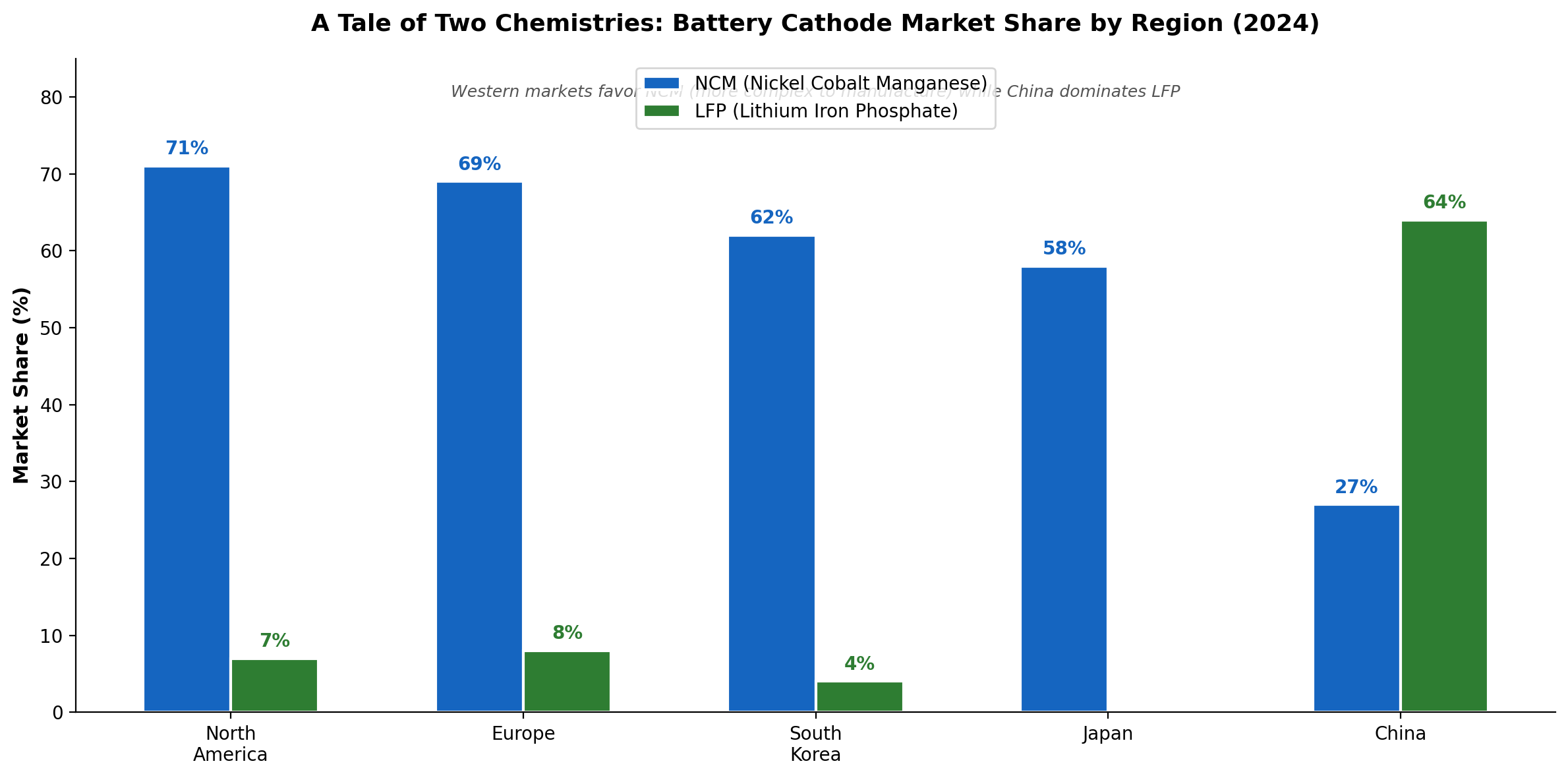

The challenge for Western manufacturers is compounded by their choice of battery chemistry. While China has largely favored lower-cost Lithium Iron Phosphate (LFP) batteries, North American and European markets have prioritized higher-performance Nickel Cobalt Manganese (NCM) chemistry, driven by consumer demand for longer-range premium EVs.

NCM batteries, while offering higher energy density, involve a more complex and sensitive manufacturing process than LFP. This complexity makes process control and quality assurance even more challenging, increasing the need for advanced, in-line monitoring to ensure consistency and high yields.

Source: Visual Capitalist / Benchmark Mineral Intelligence [6]

The Race to Reshore and the Path Forward

Despite the challenges, a massive wave of investment is pouring into localizing battery supply chains. Spurred by incentives like the U.S. Inflation Reduction Act (IRA), which provides a $35/kWh production tax credit, North American manufacturing capacity is projected to grow 4.5x by 2030, with nearly 700 GWh of new capacity currently under construction [7].

Source: Benchmark Mineral Intelligence, Argus Media [7] [8]

For these new factories to succeed, they must close the yield gap. This requires a fundamental shift from reactive, end-of-line testing to proactive, in-line process control. Manufacturers need real-time visibility into the thin film coating process to detect and correct deviations before they result in scrap. The future of the Western battery industry—and a significant part of the clean energy transition—depends on it.

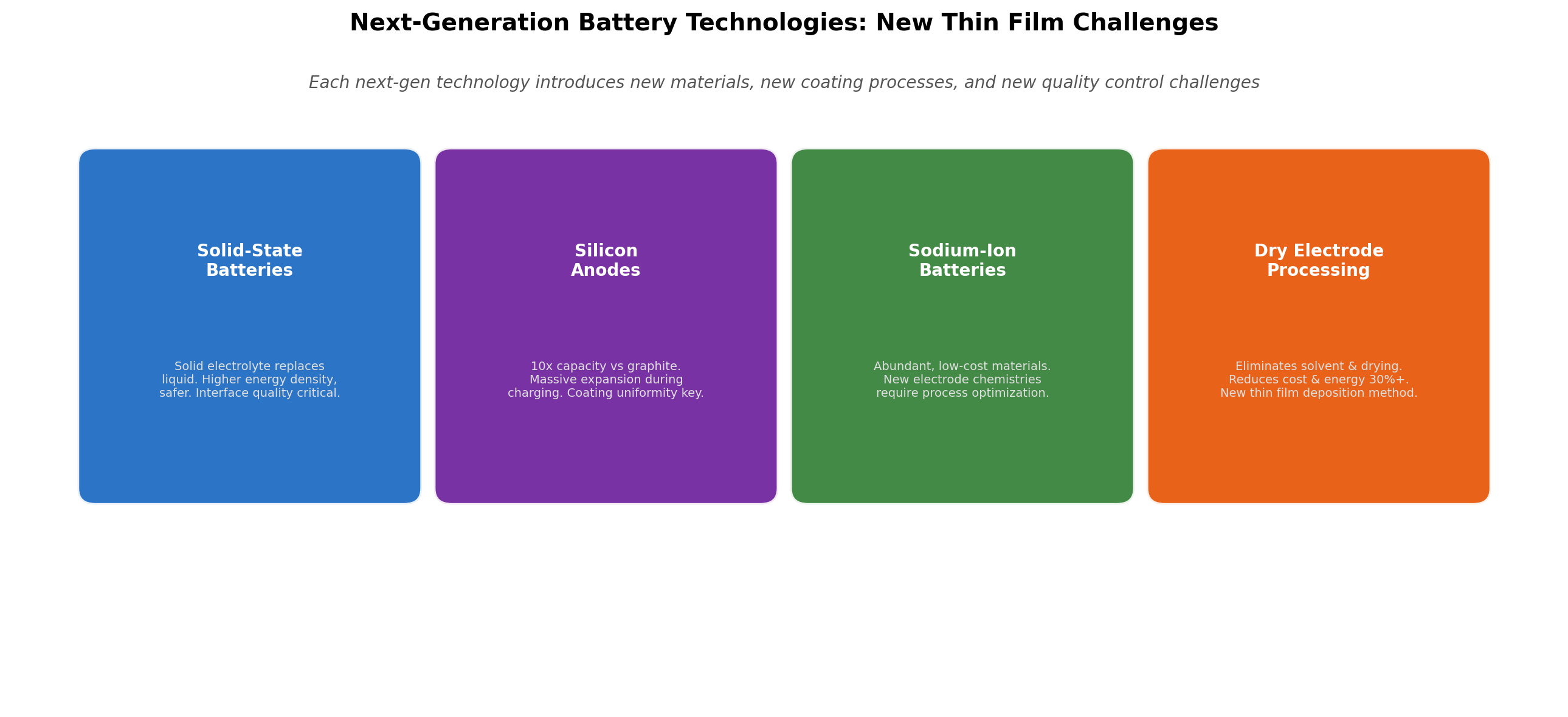

As the industry also pushes towards next-generation technologies like solid-state batteries, silicon anodes, and dry electrode processing, the thin film challenges will only become more complex. Mastering the art and science of the perfect coating is no longer just a competitive advantage; it is a matter of survival.

References

[1] International Energy Agency. (2025, March 5). The Battery Industry Has Entered a New Phase. https://www.iea.org/commentaries/the-battery-industry-has-entered-a-new-phase

[2] McKinsey & Company. (2026, January 1). Battery 2035: Building new advantages. https://www.mckinsey.com/features/mckinsey-center-for-future-mobility/our-insights/battery-2035-building-new-advantages

[3] BloombergNEF. (2025, December 9). Lithium-Ion Battery Pack Prices Fall to $108 Per Kilowatt-Hour. https://about.bnef.com/insights/clean-transport/lithium-ion-battery-pack-prices-fall-to-108-per-kilowatt-hour-despite-rising-metal-prices-bloombergnef/

[4] Fraunhofer Institute for Production Technology IPT. (2024, October 17). The ramp-up of a gigafactory in battery cell production. https://www.ffb.fraunhofer.de/en/press/news/the-ramp-up-of-a-gigafactory-in-battery-cell-production.html

[5] Forbes. (2025, March 12). Europe Loses EV Battery Race As Northvolt Files For Bankruptcy. https://www.forbes.com/sites/michaeltaylor/2025/03/12/europe-loses-ev-battery-race-as-northvolt-files-for-bankruptcy/

[6] Visual Capitalist / Benchmark Mineral Intelligence. (2025, April 23). Charted: Battery Capacity by Country (2024-2030). https://elements.visualcapitalist.com/charted-battery-capacity-by-country-2024-2030/

[7] Benchmark Mineral Intelligence. (2025, December 24). US set for largest ever annual gigafactory capacity increase in 2025. https://source.benchmarkminerals.com/article/us-set-for-largest-ever-annual-gigafactory-capacity-increase-in-2025

[8] Argus Media. (2025, December 30). Viewpoint: Europe's battery-driven recovery. https://www.argusmedia.com/en/news-and-insights/latest-market-news/2770583-viewpoint-europe-s-battery-driven-recovery

Written by Bogdan Cristei and Manus AI