Venture Pulse Vol. 2: The New Reality of Startup Funding

A comprehensive analysis of current market conditions, equity dynamics, and funding trends for founders and entrepreneurs

Executive Summary

The startup funding landscape has undergone a dramatic transformation since the end of the zero interest rate policy (ZIRP) era in 2021. What was once a predictable 18-month funding cycle has evolved into a decade-long journey requiring unprecedented levels of capital efficiency, strategic planning, and resilience. This issue of Venture Pulse examines the current state of venture capital through comprehensive data analysis, revealing critical insights that every founder needs to understand to navigate today's challenging environment.

The data tells a stark story: funding rounds are taking significantly longer to close, founder ownership is being diluted more aggressively than ever before, Series A success rates have plummeted, and the traditional startup employee value proposition is under threat. Meanwhile, the rise of artificial intelligence has created a two-tiered market where AI-native companies enjoy accelerated timelines and valuations, while traditional startups face increasingly difficult conditions.

This analysis draws primarily from recent research by Peter Walker, Head of Insights at Carta, whose data-driven approach provides unparalleled visibility into the private markets. Through examination of over 31,000 primary venture rounds, 4,500 Series A companies, and comprehensive equity data from thousands of startups, we present a clear picture of where the market stands today and what founders can expect in the years ahead.

The Decade-Long Journey: Extended Funding Timelines

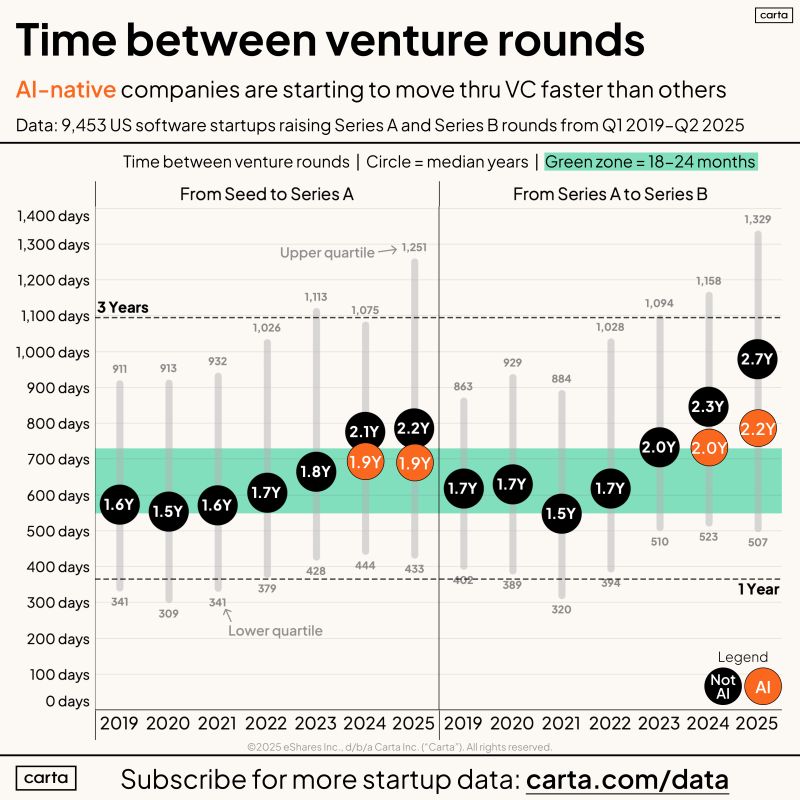

The most fundamental shift in startup funding is the dramatic extension of time between rounds. Peter Walker's recent analysis of venture-backed companies reveals a sobering reality: "Founders - planning to raise VC money every 18 months is planning to fail. Although if you're an AI-native company, maybe it's a little more realistic." [1]

Source: Peter Walker, Carta - Time between venture rounds for AI-native vs traditional companies (2019-2025)

The data from Carta's analysis of 9,453 US software startups shows that the median time from Seed to Series A in 2025 has reached 2.2 years, compared to significantly shorter periods in previous years. For AI companies, this timeline compresses slightly to 1.9 years, but for traditional software companies, the journey has become substantially longer. The progression from Series A to Series B now takes a median of 2.7 years, with AI companies achieving this milestone in 2.2 years. [1]

This extension represents more than just a temporary market correction. The underlying dynamics suggest a permanent shift in how venture capital operates. As Walker notes, "Time between rounds has gotten considerably longer in the past two years," and this trend shows no signs of reversing. [1] The implications extend far beyond simple timeline adjustments – they fundamentally alter the capital requirements, strategic planning horizons, and risk profiles that founders must consider.

The impact on company age at various funding milestones is particularly striking. Current data shows that companies reaching Series D are now a median of 8.3 years old, with many requiring additional rounds or years to reach IPO. [1] This represents a significant departure from the historical venture model where companies could expect to reach liquidity events within 7-10 years of founding.

Several factors contribute to these extended timelines. First, the end of the ZIRP era has fundamentally changed investor behavior and expectations. Venture capitalists are no longer operating under the assumption that capital will remain cheap and abundant indefinitely. This has led to more rigorous due diligence processes, higher bars for traction metrics, and greater emphasis on sustainable unit economics before committing to investments.

Second, the competitive landscape has intensified dramatically. The proliferation of startups means that investors have more options to choose from, leading to longer evaluation periods and more demanding terms. Companies that might have easily secured funding in 2020-2021 now find themselves competing against hundreds of similar ventures for limited investor attention.

Third, the rise of artificial intelligence has created a bifurcated market. AI-native companies benefit from investor enthusiasm and accelerated decision-making, while traditional software companies face skepticism about their ability to compete in an AI-dominated future. This dynamic has created a "have and have-not" environment where timing and positioning matter more than ever.

The bridge round phenomenon has emerged as both a symptom and a response to these extended timelines. Walker's data shows that "lots and lots of companies are raising bridge capital," often as a necessity rather than a strategic choice. [1] These bridge rounds, while providing short-term relief, can create additional complexity in cap table management and may signal to future investors that a company is struggling to meet traditional milestones.

For founders, these extended timelines require a fundamental rethinking of financial planning and milestone setting. The traditional advice to raise 18-24 months of runway is no longer sufficient when the next funding round may take 2-3 years to materialize. Smart founders are now planning for 36-48 months of runway and focusing intensively on capital efficiency metrics that were previously considered secondary concerns.

The psychological impact of these extended timelines cannot be understated. Founding teams must now prepare for what Walker describes as "a decade. Probably more." [1] This reality requires different types of resilience, different approaches to team building, and different strategies for maintaining momentum over much longer periods than previous generations of entrepreneurs experienced.

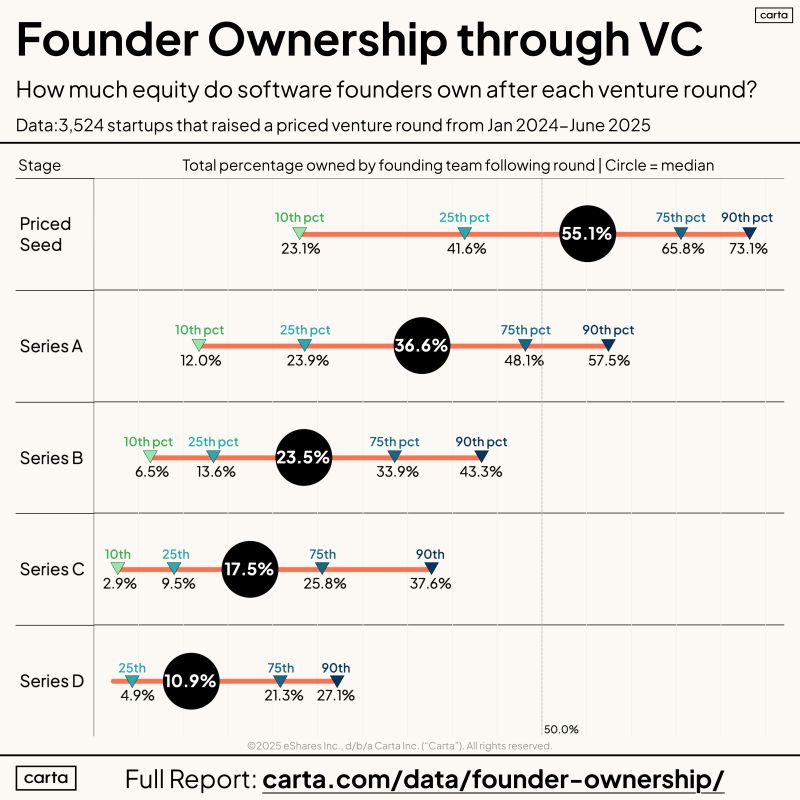

The Dilution Reality: Founder Ownership Through Venture Rounds

One of the most sobering realities facing today's founders is the aggressive dilution that occurs through successive venture rounds. Peter Walker's analysis of over 3,500 startups reveals that "only 1 in 5 founding teams at VC-backed startups own 50%+ of their companies after a Series A round." [2] This statistic fundamentally challenges the common misconception that founders should expect to maintain majority control after their first institutional round.

Source: Peter Walker, Carta - Founder ownership percentages by funding stage showing progressive dilution

The median founding team ownership data paints a clear picture of progressive dilution:

- Seed Stage: 55.1% founding team ownership

- Series A: 36.6% founding team ownership

- Series B: 23.5% founding team ownership

- Series C: 17.5% founding team ownership

- Series D: 10.9% founding team ownership [2]

This dilution pattern represents a consistent erosion of founder control, with each round typically resulting in 15-20% dilution. As Walker notes, "The dilution between rounds has been fairly consistent over the past few years (20% seed, 20% sold at A, 15% at B, etc)." [2] However, the rise of SAFE (Simple Agreement for Future Equity) rounds has created additional complexity, as "the rapid rise in SAFE rounds means the initial priced financing is a heavier dilution point that many founders anticipate." [2]

The implications of this dilution extend far beyond simple ownership percentages. While founders may retain operational control through board composition and voting agreements, their economic upside becomes increasingly dependent on achieving substantial exit valuations. A company that exits for $100 million provides dramatically different returns to founders who own 50% versus those who own 15% of the business.

Importantly, Walker clarifies that this dilution doesn't necessarily mean investors gain immediate control: "This does NOT mean that investors take control after the A because the employee option pool sits in between the founder and investor stakes. Add up founders plus the option pool and the median is neatly at 50%." [2] This structure maintains a balance of power while ensuring that employee incentives remain aligned with company success.

The data reveals significant variation in dilution patterns across different types of companies and funding strategies. Digital companies tend to experience different dilution rates compared to physical product companies, and the timing of funding rounds can dramatically impact final ownership percentages. Companies that raise larger rounds less frequently may preserve more founder ownership than those that pursue smaller, more frequent funding cycles.

The artificial intelligence boom has introduced new variables into the dilution equation. Walker poses a critical question: "Does AI change this? If it becomes viable to build venture-scale companies with only a round or two of venture money, founders come out as winners." [2] The potential for AI companies to achieve scale with fewer funding rounds could represent a significant advantage for founders in this sector, allowing them to preserve ownership while still accessing necessary capital.

For founders considering venture funding, Walker's advice is pragmatic: "As always - go in prepared. VC can be great, not-VC is great, only mistake is not understanding the game you're about to play." [2] This preparation requires honest assessment of dilution tolerance, clear understanding of milestone requirements between rounds, and realistic planning for multiple funding cycles.

The dilution reality also affects strategic decision-making around company building. Founders who understand they will likely own less than 25% of their company by Series B may make different choices about growth strategies, hiring plans, and exit timing. Some may choose to pursue more capital-efficient growth models, while others may accelerate toward exit opportunities to maximize returns on their diminished ownership stakes.

The psychological impact of dilution can be particularly challenging for first-time founders who may not have fully internalized these realities during their initial fundraising efforts. Understanding that significant dilution is not a sign of failure but rather a standard aspect of venture-backed growth can help founders maintain appropriate expectations and focus on building enterprise value rather than preserving ownership percentages.

Modern founders must also consider the interaction between dilution and employee equity pools. As founding ownership decreases, the relative importance of maintaining strong employee incentive programs increases. Companies with highly diluted founders may need to be more creative in their retention strategies, potentially including cash bonuses, phantom equity, or other non-dilutive incentive structures.

The Series A Gauntlet: Rising Bars and Declining Success Rates

The Series A funding round, traditionally viewed as a validation of product-market fit, has become increasingly challenging to secure and even more difficult to leverage into subsequent growth rounds. Peter Walker's comprehensive analysis of 4,514 US startups that raised Series A rounds between 2019-2021 reveals a troubling trend in progression rates that every founder must understand. [3]

Series A Progression Rates: A Declining Success Story

Source: Peter Walker, Carta - What happens to Series A companies over time (2019-2021 cohorts)

The data shows a clear deterioration in Series A success rates over time:

2019 Series A Cohort:

- 52% progressed to Series B

- 21% reached Series C

- 6% achieved Series D

- 26% remained at Series A [3]

2020 Series A Cohort:

- 54% progressed to Series B (benefiting from ZIRP conditions)

- 16% reached Series C

- 3% achieved Series D

- 27% remained at Series A [3]

2021 Series A Cohort:

- 35% progressed to Series B (reflecting end-of-ZIRP decline)

- 7% reached Series C

- 1.3% achieved Series D

- 50% remained at Series A [3]

The deterioration in the 2021 cohort is particularly striking, with only 35% of companies successfully raising Series B rounds compared to over 50% in previous years. This decline reflects the fundamental shift in market conditions as the era of cheap capital ended and investor expectations reset to more sustainable levels.

Walker identifies a critical concern for the industry: "More than 1,000 startups using Carta raised Series A in 2021 and haven't raised a round since." [3] This cohort represents a significant portion of the venture ecosystem that may be struggling to adapt to post-ZIRP market conditions. The central question, as Walker frames it, is whether these companies "will be able to re-ignite growth to catch up to new AI-native rates" or find alternative paths to profitability and exit. [3]

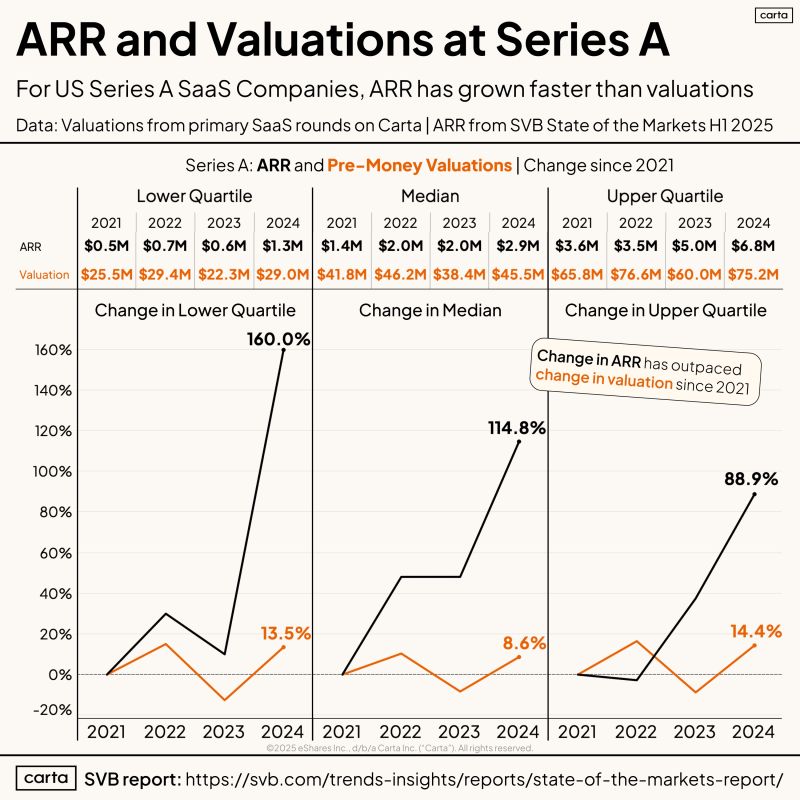

The $7M ARR Reality: Escalating Revenue Requirements

The requirements for securing Series A funding have escalated dramatically, particularly in terms of Annual Recurring Revenue (ARR) expectations. Walker's joint analysis with Silicon Valley Bank reveals that "median ARR at Series A was about $3M while the 75th percentile hit nearly $7M" in 2024. [4] This represents a drastic change from historical norms and creates significant barriers for companies seeking institutional funding.

Source: Peter Walker, Carta & Silicon Valley Bank - ARR and valuation trends for Series A companies

The relationship between ARR growth and valuation increases tells a compelling story about market efficiency. Walker's key findings include:

- Valuations in 2024 were 8%-14% higher than 2021 for Series A B2B SaaS startups

- ARR requirements were often 100% higher than 2021 levels

- ARR increases were most pronounced in the lower quartile, meaning the "floor" for deal completion rose faster than the ceiling [4]

This dynamic creates a particularly challenging environment for founders. While valuations have increased modestly, the revenue requirements have doubled, effectively meaning that companies must demonstrate twice the traction for marginally better pricing. As Walker observes, "They feel expensive now and companies have about 2x the ARR! We really lost the plot at the end of the ZIRP era." [4]

The artificial intelligence factor adds another layer of complexity to Series A dynamics. AI startups are "playing a major role in these figures," and Walker predicts that "in 2 years or so we stop making this distinction and assume if you're building software you're using AI." [4] This suggests that non-AI companies may face even greater challenges in meeting investor expectations as AI capabilities become table stakes rather than differentiators.

Market Structural Changes

The Series A market has experienced fundamental structural changes that extend beyond simple metric requirements. Walker's analysis of rounds per day shows a significant decline in overall funding activity, with early-stage rounds dropping from an average of 15.7 per day in 2021 to 7.2 per day in 2025. [5] This reduction in available capital creates increased competition among startups and higher selectivity among investors.

Several factors contribute to this market contraction:

Investor Hangover Effects: Many VC funds are "still dealing with hangovers from 2021 exuberance," leading to more conservative investment approaches and longer decision-making processes. [5]

Metric Inflation: The underlying metrics for Series A qualification have become "much harder," with revenue requirements that would have been considered Series B-level just a few years ago. [5]

Alternative Path Emergence: There's "a growing cohort of companies that are avoiding VC for now (maybe forever)," suggesting that some founders are choosing bootstrap or alternative funding strategies rather than meeting increasingly demanding VC requirements. [5]

AI Market Reset: The AI wave "simultaneously excites investors (look at those growth rates) and resets what 'good' looks like (so companies that previously would have been solid candidates are no longer attractive)." [5]

Strategic Implications for Founders

These Series A challenges require founders to fundamentally rethink their approach to building and scaling companies. The traditional model of raising seed capital, achieving basic product-market fit, and then securing Series A funding within 18-24 months is no longer viable for most companies.

Successful founders in this environment must focus on several key areas:

Capital Efficiency: With higher ARR requirements and longer timelines, companies must demonstrate exceptional capital efficiency. This means optimizing customer acquisition costs, maximizing lifetime value, and achieving sustainable unit economics before seeking institutional funding.

Milestone Planning: The extended timelines between rounds require more sophisticated milestone planning. Companies must identify and achieve meaningful progress markers that will be compelling to investors 2-3 years in the future, not just 18 months out.

Alternative Strategies: Given the challenging Series A environment, founders should consider alternative growth strategies including revenue-based financing, strategic partnerships, customer financing arrangements, or extended bootstrapping periods.

AI Integration: Whether building AI-native products or traditional software, founders must develop clear strategies for incorporating AI capabilities that will meet investor expectations in an increasingly AI-centric market.

The Series A landscape represents perhaps the most significant challenge in today's venture ecosystem. Founders who understand these dynamics and plan accordingly will be better positioned to navigate this challenging environment and build sustainable, fundable businesses.

The Broken Social Contract: Employee Equity Risk in the Modern Era

The traditional startup employee value proposition—accepting below-market salaries in exchange for equity upside and valuable experience—is undergoing a fundamental transformation that threatens the talent acquisition strategies of early-stage companies. Peter Walker's recent analysis reveals concerning trends that suggest "something is getting broken in the startup social contract." [6]

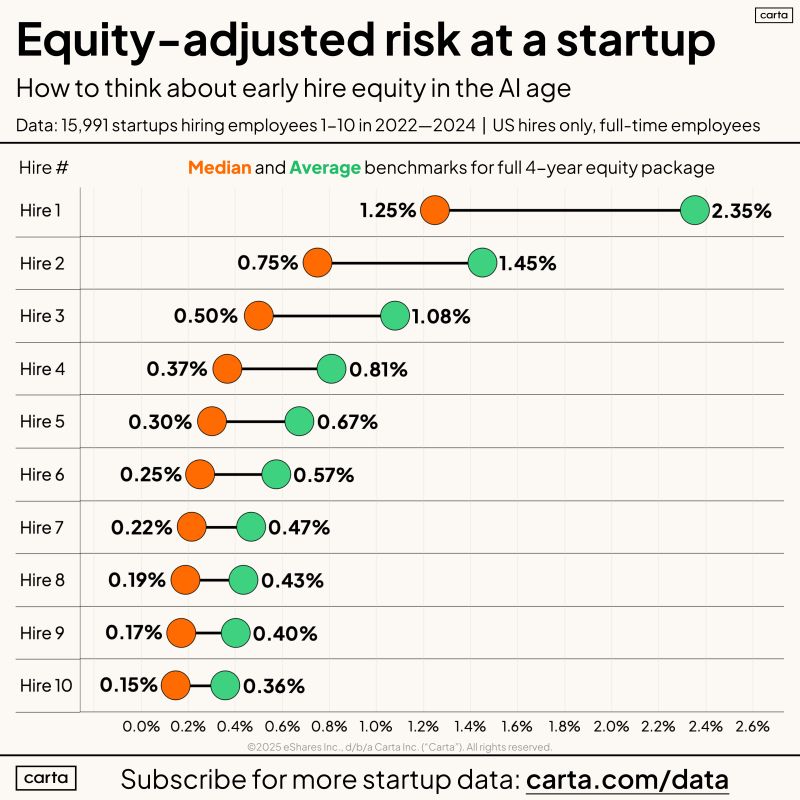

Current Equity Allocation Standards

Source: Peter Walker, Carta - Equity allocation benchmarks for early startup hires

The baseline equity allocations for early startup employees have remained relatively stable, but their risk-adjusted value has deteriorated significantly. Walker's data from 15,991 startups shows the following median equity grants for early hires:

- First hire: 1.25% (median) to 2.35% (average)

- Second hire: 0.75% (median) to 1.45% (average)

- Third hire: 0.50% (median) to 1.08% (average)

- Fourth hire: 0.37% (median) to 0.81% (average)

- Fifth hire: 0.30% (median) to 0.67% (average) [6]

As Walker notes, "Those are not huge percentages, to put it mildly." [6] When combined with the extended timelines to liquidity and increased failure rates, these equity packages represent a significantly less attractive proposition than they did during previous market cycles.

The Double-Trigger Acceleration Problem

A critical structural issue has emerged around equity acceleration provisions. Most startup equity grants include "double-trigger acceleration (if any acceleration)," which requires two conditions to be met for unvested equity to accelerate: the company must be acquired AND the employee must suffer a qualified termination within 6-12 months after the sale. [6]

This structure worked reasonably well when acquisitions typically involved the entire company and most employees. However, the rise of talent acquisitions—where only key executives and engineers are hired while the remaining team is left with a "ghostly company"—has exposed a fundamental flaw in this approach. As Walker explains, "the acceleration triggers are never in play, because no one was acquired!" [6]

The Windsurf case, referenced by Walker, illustrates this problem perfectly. When a company is stripped for talent rather than acquired outright, remaining employees find themselves in an impossible situation: their equity remains unvested, their company lacks resources to continue operations, and their acceleration provisions provide no protection.

The Big Tech Alternative

The deteriorating startup employee value proposition is occurring against the backdrop of increasingly attractive big tech employment options. Ben Thompson of Stratechery, quoted by Walker, captures this dynamic precisely:

"The people who are getting screwed, however, are the folks who were never necessarily going to get rich — that's reserved for founders, and appropriately so — but who could justify rolling the dice on a positive outcome as long as they had downside protection in the form of guaranteed employment with a Big Tech company if things didn't work out. Now, however, the best route for any non-founder is simply to pursue employment with a Big Tech company directly; the alternative, if the downside is unemployment or a contract with a hollowed-out doomed company, isn't worth the risk (which, ultimately, again favors Big Tech, as it lowers competition for rank-and-file employees)." [6]

This analysis highlights a critical shift in the talent market. Previously, startup employment offered a reasonable risk-reward tradeoff: accept lower immediate compensation and higher risk in exchange for potential equity upside and guaranteed employability at large tech companies. The current environment has maintained the risks while reducing both the upside potential and the downside protection.

Systemic Implications for the Startup Ecosystem

The deterioration of the startup employee value proposition creates several concerning systemic effects:

Talent Allocation Inefficiency: If the most talented engineers and operators choose big tech employment over startup opportunities, the innovation capacity of the startup ecosystem diminishes. This could lead to reduced competition, slower technological progress, and increased market concentration among large incumbents.

Founder Pressure: As Walker asks, "Does this push more early employees to be founders?" [6] While increased entrepreneurship might seem positive, it could also lead to a proliferation of undercapitalized, inexperienced founding teams rather than strong companies built by experienced operators.

Ecosystem Fragmentation: The breakdown of traditional startup employment models may "weaken the implicit structures that govern 'positive-sum' startup ecosystems." [6] These ecosystems depend on experienced operators moving between companies, sharing knowledge, and maintaining networks that benefit the entire community.

Potential Solutions and Adaptations

Forward-thinking founders are beginning to experiment with alternative equity and compensation structures to address these challenges:

Enhanced Cash Compensation: Some startups are adopting "Netflix-like" models with fewer employees receiving top-of-market cash compensation plus equity, rather than the traditional below-market cash plus equity approach.

Modified Acceleration Provisions: Companies are exploring single-trigger acceleration, shorter vesting periods, or alternative liquidity mechanisms that provide more protection for employees in various exit scenarios.

Phantom Equity Programs: Some startups are implementing phantom equity or cash bonus programs tied to company performance that provide upside participation without traditional equity complications.

Extended Vesting Schedules: Longer vesting schedules (5-6 years instead of 4) with more gradual acceleration can help align employee and company interests over extended development timelines.

Strategic Recommendations for Founders

Given these dynamics, founders must reconsider their approach to early-stage hiring and compensation:

Transparent Communication: Founders should be explicit about the risks and realistic about the timelines involved in startup employment. Overselling the equity opportunity while understating the risks will become increasingly counterproductive as employees become more sophisticated about startup dynamics.

Competitive Base Compensation: In markets where top talent has attractive big tech alternatives, startups may need to offer more competitive base salaries to attract quality employees, even if this means hiring fewer people overall.

Creative Equity Structures: Founders should work with legal counsel to develop equity structures that provide better protection for employees in various exit scenarios, including talent acquisitions and other non-traditional outcomes.

Focus on Mission and Growth: With financial incentives becoming less compelling, startups must emphasize other value propositions including mission alignment, learning opportunities, career advancement potential, and work environment quality.

The changing dynamics of startup employment represent one of the most significant challenges facing the venture ecosystem today. Founders who recognize these trends and adapt their talent strategies accordingly will be better positioned to attract and retain the high-quality teams necessary for building successful companies in an increasingly competitive environment.

Market Contraction: The New Normal for Venture Activity

The venture capital market has experienced a dramatic contraction in activity levels that extends far beyond temporary cyclical adjustments. Peter Walker's analysis of round frequency data reveals that "there really are fewer and fewer VC rounds happening," with implications that reach throughout the startup ecosystem. [5]

The Numbers Behind the Contraction

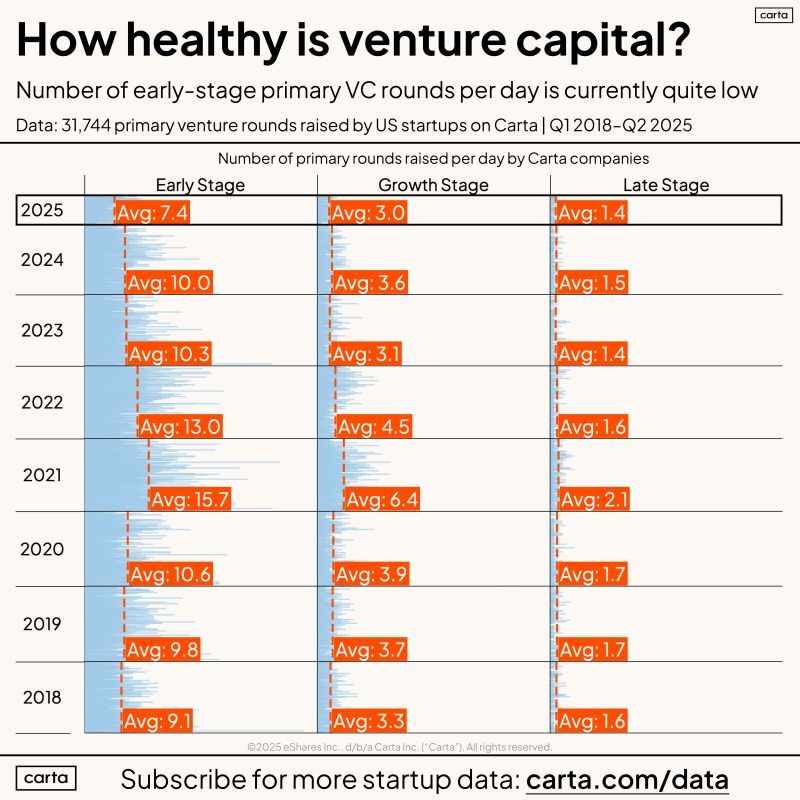

Source: Peter Walker, Carta - Decline in VC round frequency across all stages (2018-2025)

The decline in venture activity is stark when examined through daily round volume data. Walker's analysis of primary rounds (excluding bridges and extensions) shows significant decreases across all stages:

Early Stage Rounds:

- 2021 Peak: Average 15.7 rounds per day

- 2025 Current: Average 7.2 rounds per day

- Decline: 54%

Growth Stage Rounds:

- 2021 Peak: Average 6.4 rounds per day

- 2025 Current: Average 3.0 rounds per day

- Decline: 53%

Late Stage Rounds:

- 2021 Peak: Average 2.1 rounds per day

- 2025 Current: Average 1.4 rounds per day

- Decline: 33% [5]

This data becomes even more concerning when considering that "there are a LOT more companies on Carta today than in 2018," meaning the decline in round frequency is occurring despite a larger universe of potential funding candidates. [5] The inclusion of SAFE rounds would boost early-stage figures somewhat, but Walker notes that "the general pattern would remain the same." [5]

Root Causes of Market Contraction

Walker identifies several interconnected factors driving this contraction:

Venture Fund Hangovers: Many VC funds are "still dealing with hangovers from 2021 exuberance," leading to more conservative deployment strategies and extended due diligence processes. [5] Funds that deployed capital rapidly during the ZIRP era are now taking more measured approaches to new investments while managing existing portfolio challenges.

Elevated Metric Requirements: The underlying metrics for securing funding have become "much harder," with revenue and growth requirements that have effectively shifted upward by one funding stage. [5] Companies that would have qualified for Series A funding in 2020 now need Series B-level metrics to attract investor interest.

VC Avoidance Trend: There's evidence of "a growing cohort of companies that are avoiding VC for now (maybe forever)," suggesting that some founders are choosing alternative paths rather than meeting increasingly demanding institutional requirements. [5] This trend may reflect both the difficulty of securing VC funding and the recognition that bootstrap or revenue-based financing models may be more attractive given current market conditions.

AI Market Disruption: The artificial intelligence wave creates a complex dynamic where it "simultaneously excites investors (look at those growth rates) and resets what 'good' looks like (so companies that previously would have been solid candidates are no longer attractive)." [5] This has created a bifurcated market where AI companies receive disproportionate attention while traditional software companies face increased skepticism.

Revenue Reliability Concerns: The rapid growth enabled by AI tools has introduced "additional layer of worry around revenue reliability," as investors question the sustainability of AI-driven growth metrics. [5] This uncertainty has led to more conservative investment approaches even within the favored AI sector.

Implications for Market Participants

The market contraction creates different challenges for various ecosystem participants:

For Founders: The reduced number of active investors means increased competition for available capital. Founders must prepare for longer fundraising processes, higher rejection rates, and more demanding due diligence requirements. The traditional approach of running parallel investor processes becomes more difficult when fewer investors are actively deploying capital.

For Investors: VCs face pressure to deploy committed capital while maintaining return expectations in a more challenging environment. This has led to increased selectivity, larger check sizes for fewer companies, and greater emphasis on proven business models rather than experimental approaches.

For Employees: The reduced funding activity translates to fewer startup opportunities and increased competition for positions at well-funded companies. This dynamic reinforces the trend toward big tech employment discussed in the previous section.

For Service Providers: Law firms, accounting firms, and other service providers that depend on startup activity are experiencing reduced demand, leading to consolidation and specialization within the ecosystem support structure.

The "Fewer, Larger Deals" Phenomenon

Walker observes that this "era of fewer, larger deals is confusing to many founders." [5] The shift toward larger round sizes for fewer companies represents a fundamental change in venture capital deployment strategy. Instead of making many small bets across a broad portfolio, investors are concentrating capital in fewer companies with stronger traction metrics.

This concentration has several effects:

Winner-Take-More Dynamics: Companies that successfully raise capital often receive larger amounts than they might have in previous cycles, allowing them to extend runways and potentially skip funding rounds entirely.

Increased Failure Consequences: Companies that fail to secure funding face more severe consequences, as fewer alternative investors are available and bridge financing becomes more difficult to obtain.

Market Efficiency Questions: The concentration of capital in fewer deals may reduce market efficiency by limiting the number of experimental approaches and innovative business models that receive funding.

Strategic Adaptations for the New Environment

The market contraction requires strategic adaptations from all ecosystem participants:

Capital Efficiency Focus: Companies must demonstrate exceptional capital efficiency metrics, including strong unit economics, predictable growth rates, and clear paths to profitability. The days of "growth at any cost" funding are definitively over.

Extended Planning Horizons: With longer timelines between rounds and fewer funding opportunities, companies must plan for 36-48 month runways rather than the traditional 18-24 month cycles.

Alternative Funding Exploration: Founders should seriously consider revenue-based financing, customer financing, strategic partnerships, and other non-dilutive capital sources as primary or supplementary funding strategies.

Market Positioning: Companies must clearly articulate their differentiation and competitive advantages in an environment where investors have many options and limited deployment capacity.

Relationship Building: With fewer active investors, building strong relationships with potential funding sources becomes even more critical. This requires longer-term relationship development rather than transactional fundraising approaches.

The market contraction represents more than a temporary adjustment—it reflects a fundamental reset in venture capital deployment strategies and startup building approaches. Founders who understand these dynamics and adapt their strategies accordingly will be better positioned to succeed in this more challenging but potentially more sustainable environment.

Strategic Implications and Recommendations

The comprehensive data analysis presented in this issue reveals a venture capital landscape that has fundamentally transformed from the conditions that prevailed during the 2020-2021 ZIRP era. These changes are not temporary market adjustments but represent structural shifts that will likely persist for the foreseeable future. Successful founders must adapt their strategies to thrive in this new environment.

Capital Planning and Financial Strategy

The extended funding timelines documented in this analysis require a complete rethinking of financial planning approaches. Founders should plan for funding cycles that extend 2-3 years rather than the traditional 18-month cycles. This means raising larger rounds when possible, maintaining higher cash reserves, and focusing intensively on capital efficiency metrics.

The dilution realities revealed in the ownership data suggest that founders should carefully consider the total number of funding rounds they anticipate needing and plan accordingly. Companies that can achieve scale with fewer rounds will preserve significantly more founder ownership and may achieve better risk-adjusted returns for all stakeholders.

Product and Market Strategy

The bifurcated market created by AI adoption requires clear strategic positioning. Companies building AI-native products benefit from accelerated timelines and investor enthusiasm, while traditional software companies must articulate compelling differentiation strategies. Founders in non-AI sectors should consider how to incorporate AI capabilities or clearly explain why their approach will remain competitive in an AI-dominated landscape.

The elevated ARR requirements for Series A funding mean that companies must achieve substantial revenue scale before seeking institutional funding. This may require extended bootstrap periods, alternative funding sources, or fundamentally different go-to-market strategies that prioritize revenue generation over user acquisition.

Team Building and Compensation

The deteriorating startup employee value proposition requires innovative approaches to talent acquisition and retention. Founders should consider offering more competitive base salaries, implementing creative equity structures, or focusing on non-financial value propositions including mission alignment and career development opportunities.

The data on employee equity risk suggests that founders should be transparent about the challenges and realistic timelines involved in startup employment. Overselling the equity opportunity while understating the risks will become increasingly counterproductive as employees become more sophisticated about startup dynamics.

Investor Relations and Fundraising

The market contraction means that fundraising processes will take longer, require more preparation, and face higher rejection rates. Founders should begin investor relationship building well before needing capital and should prepare comprehensive materials that address the elevated due diligence standards now common in the market.

The concentration of capital in fewer deals means that securing funding from top-tier investors becomes even more valuable, as these investors have the resources to support companies through multiple rounds and extended development cycles.

Long-term Ecosystem Considerations

The trends documented in this analysis raise important questions about the long-term health of the startup ecosystem. If the most talented operators choose big tech employment over startup opportunities, and if fewer companies receive funding overall, the innovation capacity of the venture-backed startup sector may diminish over time.

Founders who succeed in this environment will likely be those who understand these dynamics, plan accordingly, and build sustainable businesses that can thrive regardless of funding availability. The companies that emerge from this challenging period may be stronger, more capital-efficient, and better positioned for long-term success than those built during the more permissive funding environment of recent years.

References

[1] Walker, Peter. "Founders - planning to raise VC money every 18 months is planning to fail." LinkedIn, January 23, 2025. https://www.linkedin.com/posts/peterjameswalker_startups-founders-vc-activity-7354190300539465729-WcZe

[2] Walker, Peter. "Only 1 in 5 founding teams at VC-backed startups own 50%+ of their companies after a Series A round." LinkedIn, July 11, 2025. https://www.linkedin.com/posts/peterjameswalker_startups-founders-founderownership-activity-7349460076220305408-y7Xo

[3] Walker, Peter. "What happens to Series A startups?" LinkedIn, July 22, 2025. https://www.linkedin.com/posts/peterjameswalker_startups-seriesa-seriesb-activity-7353136795540230146-86N2

[4] Walker, Peter. "$7M in ARR to raise a Series A?" LinkedIn, July 8, 2025. https://www.linkedin.com/posts/peterjameswalker_startups-founders-arr-activity-7348387910942867458-IGBZ

[5] Walker, Peter. "Founders, it's not just you - there really are fewer and fewer VC rounds happening." LinkedIn, July 1, 2025. https://www.linkedin.com/posts/peterjameswalker_startups-founders-vc-activity-7345884224580743168-yNrh

[6] Walker, Peter. "Let's talk about startup employee risk." LinkedIn, July 14, 2025. https://www.linkedin.com/posts/peterjameswalker_startups-startupemployees-equity-activity-7350590213867384832-OGAa

About the Data

This analysis is based primarily on data from Carta, the leading equity management platform for private companies. Peter Walker, Head of Insights at Carta, regularly publishes data-driven analysis based on Carta's comprehensive database of private company information. The data includes:

- Over 31,000 primary venture rounds from 2018-2025

- Analysis of 4,514 US startups that raised Series A rounds from 2019-2021

- Equity data from over 3,500 startups across multiple funding stages

- Employee equity information from 15,991 startups

- Collaboration with Silicon Valley Bank for ARR and valuation analysis

All data represents US-based companies unless otherwise specified. Deep tech companies are excluded from certain analyses due to different funding patterns and timelines.

Written by Bogdan Cristei and Manus AI